Personal Budget Worksheet Template

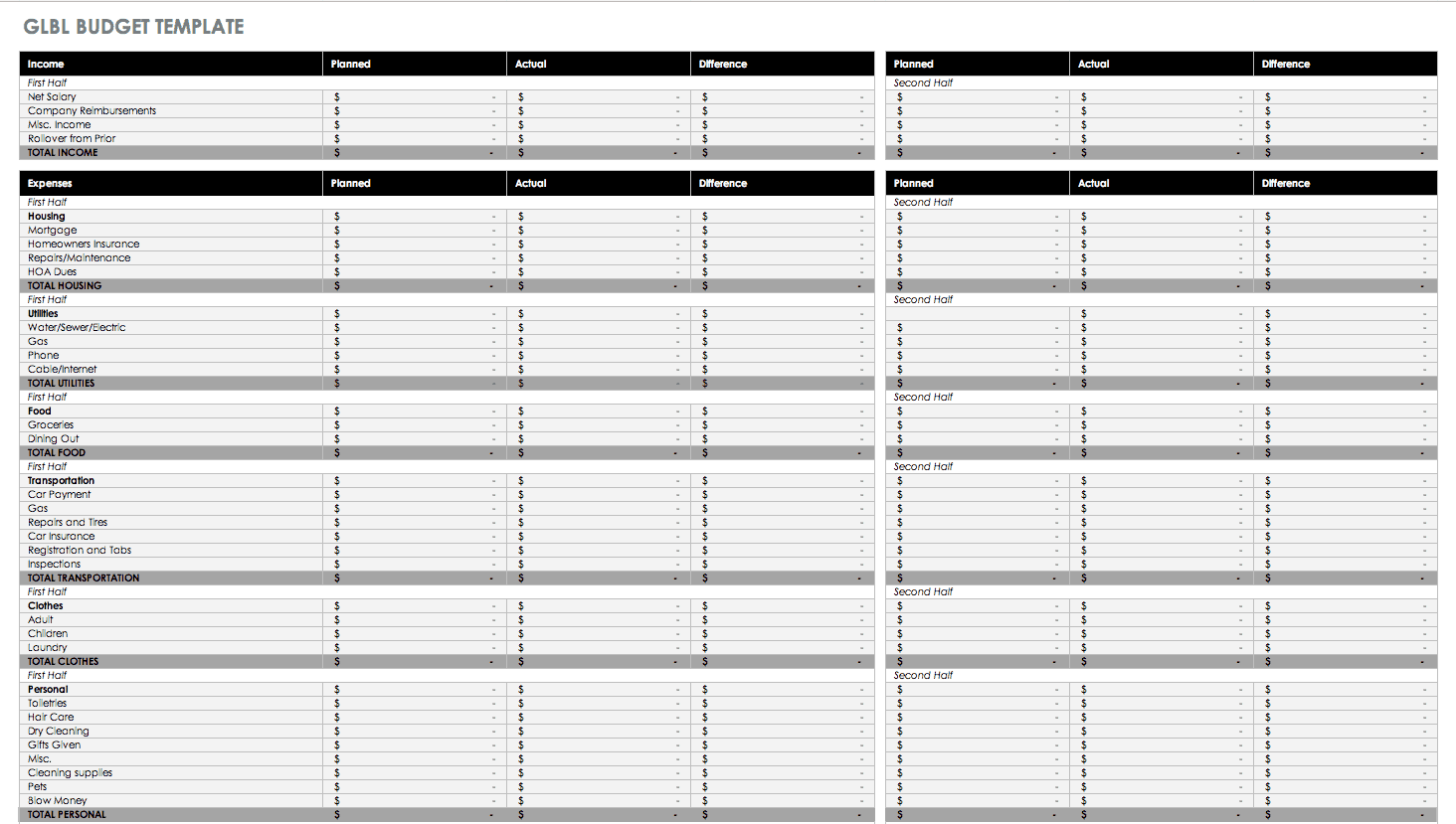

Personal Budget Worksheet Template – A personal or family budget is a written list of expected income and expenses that help you plan your spending or saving, as well as track your actual spending patterns. The word budget makes some people think that spending money is in the corner, but it is wise to know where your money is going. You might be surprised how much you spend on Coffee and Lattes!! We have provided you with a free printable monthly budget worksheet template for you to print and use. Even in the digital age, keeping these monthly budgets in a nice binder makes it easy to see the hard copy in front of you and for easy reference.

A budget is a real tool to get a better and more accurate understanding of your spending habits. By calculating all your income and all your monthly expenses, you will get a true picture of your cash flow, allowing you to make better, more informed financial decisions. An accurate budget will help you better understand your strengths and weaknesses.

Personal Budget Worksheet Template

If you’re seeing your finances change due to an unexpected recession or job loss, if you want to start saving more, or if you’ve been using your credit card a lot, now is a good time to check out these resources. and learn how to protect your family from debt and use your extra money wisely. ‹ ›

Download Printable Monthly Budget

Because everyone’s financial situation is different, you may find that not all of the categories listed in the worksheet below apply to your income or expenses. You may even notice that some months are different from others, but after doing this work you must be sure that you are well prepared for those changes and unexpected expenses. Here is a monthly budget template.

While the monthly budget cycle is often the best time to set a personal or family budget, there are many sources of income and expenses that don’t fit into a monthly plan. For example, you can receive your payment every week or every two weeks instead of once a month. In that case, calculate how much it combines during the month and write in the appropriate sentence and sentence. You may also have other expected or recurring expenses that occur more frequently than salary. To include expenses (such as car insurance or property taxes) in your monthly budget, calculate your total expenses for the calendar year and divide by 12 to get your “monthly” income. Write that number in the row and in the appropriate column.

This section contains detailed information about each house. Some of these things can come down if you want to look at the competition, like car insurance and cable. Savings and retirement/investment are listed first for a reason. You should have a savings account in case of unexpected expenses for maintenance or job loss. The rule of thumb is to save 10% of your income, but even if you have a credit card, start somewhere that fits your budget. If you have a savings account, it helps to use a credit card. A separate savings bank account is recommended. Retirement/investment should also be high on your list. Even if you can only afford to pay $25 a week, you still have time to save for retirement. Some of the items in this section are simple.

Free Budget Templates That’ll Help You Save Without Stress

Credit cards and loans should be paid off as soon as possible when you pay the interest on that debt. The interest income you spend can get you money in investments or buy some money for your home and family. Having a savings account can help you stay out of debt.

This section provides your family with childcare, gas, entertainment, groceries, and more. more to their liking. These costs can be easily reduced, such as using grocery coupons, shopping at places like BJ’s Wholesale or Tops Markets for cheaper gas. or increasing the grocery budget, spending summer vacation at home instead of vacation, etc. Check out our weekly promotions to earn gas points and shop for the best groceries!

If you find that you are spending more money than you bring in at the end of the month, it may be time to carefully examine where you are spending your money and make adjustments where possible to recover. difference The printable monthly budget template makes it easy to see and see how much you’re spending. On the other hand, if you find that you have a steady income each month, then it is your chance to decide what to do with that extra money. Maybe you should set up an emergency or “rainy day” fund. You can also contribute more to your retirement savings. Consider paying off some debts early in order to save on important or large purchases. To make this process easier, you can also use the free Mint.com app, and I will get a reward for sharing! It will enter your money (after you tell them which part of the money it is) and make filling out the page easy. You can also create your budget in the app, but the printable page is great for month-by-month reference to see where you need to make adjustments. If you want more options, read the best free budgeting apps here!

Intelligent, Free Excel Budget Calculator Spreadsheet

[…] The free monthly budget worksheet template from Vouchers for Your Family is a great choice for those new to budgeting. It is one of the easiest ways to start managing your money better and achieve your financial goals when you start trying to invest […]

It’s time to stop worrying about money and take control. All you need is a simple budget template, tracker, or spreadsheet to keep track of your money.

So, what are the best budgeting templates, tools, and apps to use? Let’s take a closer look at our favorite brands.

Free Monthly Budget Templates

A budget template helps you keep track of your monthly income and expenses – so you can easily manage your money and know where your money is going each month.

Over time, your budget will reflect your spending habits. This allows you to see where you are spending money and plan better for the future.

We’ve designed our FREE simple budget template to be as straightforward and easy to use as possible. You can customize and use it for any financial situation!

Free Budget Templates To Organize Your Finances In 2022

Our free template can be printed digitally as a budgeting worksheet or as a spreadsheet to calculate for yourself.

Nothing beats pen and paper when getting started with a monthly budget, so we’ve created a complete budget planner and some templates for you! There is even a meal plan template.

Add up your income, then subtract your fixed income, expenses, debt, and savings, and see our digital budget calculator below.

Best Budget Templates & Tools That Will Change Your Life

Google Sheets has many templates and spreadsheets to choose from, and unlike Microsoft Office, it’s free with your Gmail account.

If you like crunching numbers and tracking every last penny, the Google Sheets budget spreadsheet is perfect for you.

This type of template is perfect for people who want full control and are big on numbers. Using a budget spreadsheet is an easy way to budget.

Free Printable Monthly Budget Worksheet Template |

There are great budget templates available in Microsoft Excel, and if you have Microsoft Office, you can choose a budget spreadsheet to suit your needs.

Microsoft has a variety of products and services, and their templates are free to use, from family budgets, monthly budget templates, vacation budget templates, budget calculators, and even wedding budget trackers.

If you can’t find a pre-made template that fits your needs, you can learn how to create your own budget template in Excel.

Printable Monthly Budget Planner Template

Mint is free and by far our favorite budgeting method – Kelan and I have been using Mint to manage our finances for over 10 years!

If you just want to track your spending, know what your monthly expenses are, and meet your financial goals, Mint is the perfect budgeting solution for your budgeting needs.

Personal Capital is a great free online budgeting tool to use to track your monthly and annual expenses.

Free Printable Budget Worksheets

Of all the budgeting programs, Personal Capital easily takes the cake when it comes to tracking net worth and planning for retirement.

We usually go in

Basic personal budget template, excel personal budget template, personal annual budget template, personal budget template, easy personal budget template, monthly budget worksheet template, personal expense budget template, personal budget worksheet, personal budget planning template, personal home budget template, budget worksheet template, personal financial budget template