Colorado Llc Operating Agreement Single Member

Colorado Llc Operating Agreement Single Member – A Single Member LLC Operating Agreement is a form used to record the details of a newly formed limited liability company with one (1) member. From how it is funded to the rules of adding a new member, the form contains a number of basic provisions that outline the organization’s governance. Once completed, the form retains the entity/owner; Operating agreements do not need to be filed with the Secretary of State.

A single-member LLC is a type of business entity that is a common alternative to an independent entrepreneur. A single member LLC offers several advantages to its owner, mainly that the owner is a separate entity from the business (which protects it from most liabilities). For tax purposes, the entity is known as a “neglect entity”. This means that while the IRS “ignores” the company itself, LLC owners must file the entity’s income and expenses on a Schedule C form, via their personal tax return.

Colorado Llc Operating Agreement Single Member

The process for establishing a single member LLC is similar to establishing a multi-member LLC. The process may vary from country to country but generally consists of the following steps:

Llc Meeting Minutes Template

The first step in establishing an LLC is naming. An owner can use their country’s entity search to find a name that matches their business. The name can be almost anything, as long as it is not prohibited by state law. Most state laws require the entity to be “LLC,” “L.L.C.”, “Ltd.” Liability Co.,” or other similar words/abbreviations at the end of the company name. If the owner isn’t ready to register their new entity but finds the perfect name, they can reserve the name (usually for a fee).

A registered agent can be almost any person or entity, as long as they reside in the state in which the LLC is registered, are available during normal business hours, and are at least 18 years old (applicable to individuals only). LLC members usually prefer to appoint a registered agent in addition to themselves because it gives them the ability to select a person who will always be present to receive cases, documents and other important communications.

Articles of organization (which have different names depending on the state) are what must be filed with the state to recognize the LLC as legal and valid. It can often be submitted online for a fee.

Incorporate In Colorado

Although rarely a state requirement, this step is most important to ensure that the owner properly outlines their LLC’s purpose, governing rules, and other important matters. Some of the topics covered in the operating agreement include profit/loss, distribution, new members, compensation (salary), governance, and more.

This step is necessary for companies that want to hire employees, open business bank accounts, and more Known as an “Employer Identification Number,” an EIN is a completely unique date assigned to a business. It is usually compared to a person’s Social Security Number (SSN). One can be found relatively easily through the IRS website.

While sole proprietorships and LLCs both have a single owner and are excellent options for those looking to start a small business, they differ in several key ways.

How To Start An Llc In Oklahoma For $0

In both LLCs and sole proprietorships, taxes go directly through the entity to the business owner, who must report the income tax as an attachment to their personal tax return with a Schedule C tax form. However, unlike sole proprietorships, LLCs can opt out Tax treatment, allowing them to be taxed as C or S corporations (as long as they meet all the necessary requirements).

One of the most important differences between a single member LLC and a sole proprietorship is that in the latter there is no legal separation between the business and its owner. If the entity faces a lawsuit, it is the owner’s turn to pay any judgment. Because an LLC is a separate legal entity, it acts as a “shield” for the owner, protecting them from out-of-pocket payments and lawsuits. However, the protections that an LLC provides only work if the owner operates the entity in full compliance with the law and does not mix business and personal expenses.

Sole proprietorships may have an advantage over LLCs in that there are few restrictions on the owner (due to being a single entity in the eyes of the state). A single member LLC owner must file an annual report with the state, itemize all business expenses, and comply with state business restrictions. The operating agreement with a single-member LLC describes the business operations, management and ownership of the company with 1 owner (member). The agreement was created for formal purposes to help consolidate the company’s status as a separate entity.

What Is An Llc?

Notarization – It is recommended that the Single Member Business Agreement be notarized to prove its authenticity and date of signature.

A single member LLC is a company with one (1) owner and is typically created for tax planning purposes and to separate the owner from the company’s assets and liabilities. All income generated by the LLC, after properly deducting expenses, will be “passed through” at the same tax rate as the owner’s individual basis.

The IRS definition “An LLC is an entity established by state law… An LLC with only one member is treated as a disregarded entity separate from its owner for income tax purposes (but as a separate entity for employment tax and certain excise tax purposes), if No it files Form 8832 and affirmatively elects to be treated as a corporation.” Source: IRS (Single Member LLC) Single Member LLC vs Sole Proprietorship

Free Llc Operating Agreement Templates In 2021

Although an employment contract is highly recommended, it is only required in the states of California, Delaware, Maine, Missouri, and New York.

A single member LLC does not pay taxes at the company level (unless there is a state LLC tax). Profits from an LLC are transferred to the owner and paid on IRS Form 1040.

Yes, by filing IRS Form 2553 within 75 days of the effective date or before March 15th in any tax year.

Free 5+ Operating Agreement Contract Forms In Pdf

No. By definition, a single member LLC has only one (1) owner. Adding spouses, however, requires an amendment to the entity’s operating agreement that will convert it to a multi-member LLC.

Yes, a single member LLC can add members. However, this would make the entity a multi-member LLC, which would require an amendment to the business agreement.

That is. The term single member refers to the existence of only 1 owner. The owner can have as many employees as he wants.

Free Llc Operating Agreement

That is. A single-member LLC can pay rent to the owner if, for example, the owner is also the landlord. Although real estate cannot be held in the same single member LLC, it must be owned separately.

That is. Given that a member pays self-employment tax on earned income, he is liable to pay estimated tax throughout the year (15 April, 15 June, 15 September and 15 January). This can be done by registering with the Tax Administration through their online portal (EFPTS).

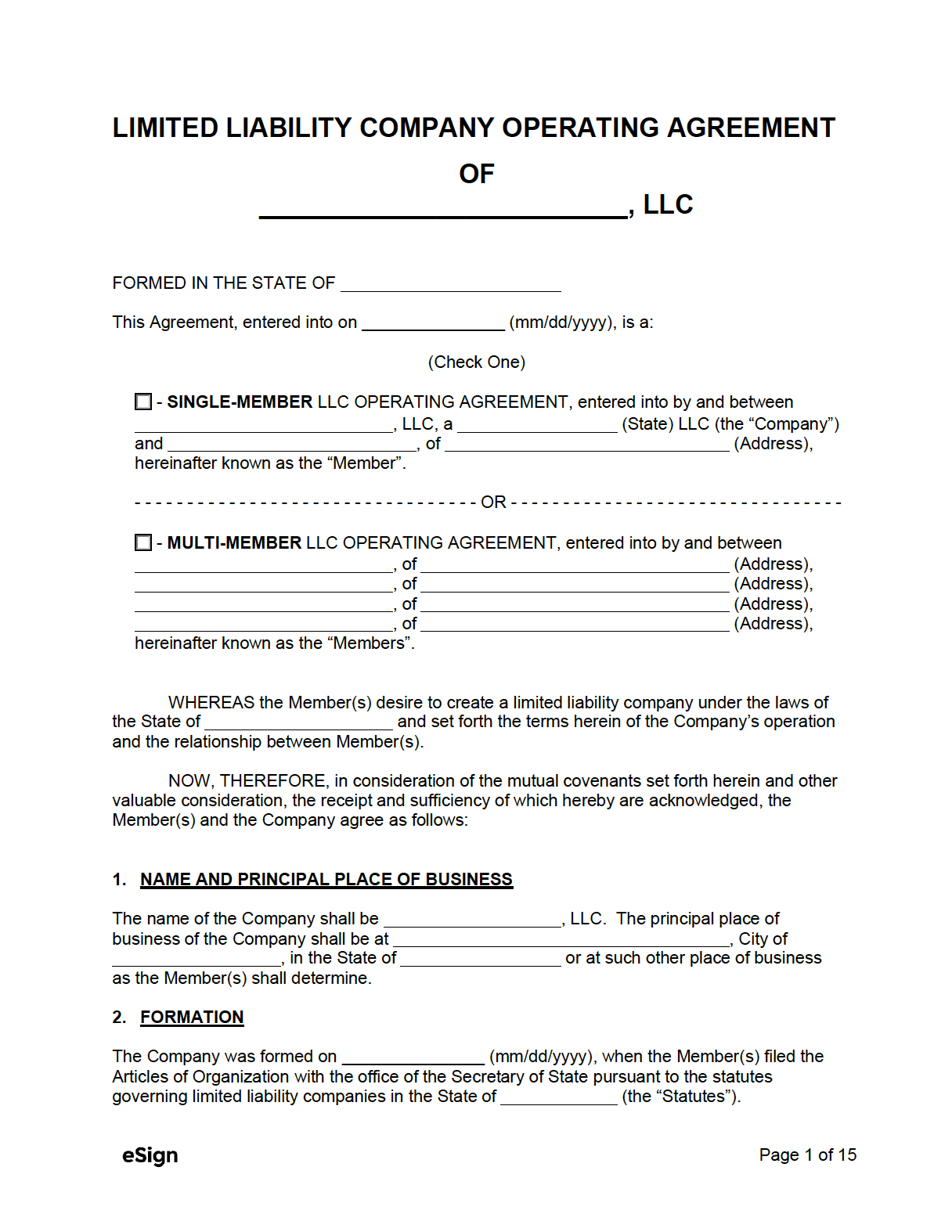

This operating agreement (the “Agreement”) is made and executed on [DATE] in favor of [NAME OF MEMBER] (“NAME OF MEMBER”), a single member limited liability company (the “Company”) and its sole proprietor. ) hereby declares the following:

Free Single Member Llc Operating Agreement

Now, therefore, for a good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the following is agreed upon:

The Company was incorporated in [COUNTRY] (the “Governing State”), under which the Company filed its Articles of Incorporation, which became effective on [DATE]. The operations of the Company shall be governed by the provisions of this Agreement and the applicable laws of the governing country relating to the establishment, operation and taxation of LLC companies, which establish guidelines and procedures for the establishment and operation of LLC companies (the “Statutes”). To the extent permitted by the Bylaws, the terms and conditions of this Agreement will prevail over any conflict between the Bylaws and this Agreement.

Ii) To carry out or participate in any and all activities and/or functions for which limited liability companies may be engaged in accordance with the statute.

Download Texas Llc Operating Agreement Template

B.) The company shall have all powers necessary and proper to carry out the purposes for which it was established, including all powers conferred by statute.

The Company shall continue in existence until dissolved, terminated or terminated in accordance with the provisions of this Agreement and, unless otherwise provided for in this Agreement, until the Articles of Association are repealed.

The registered office and resident agent of the company shall be as stated in the initial articles/certificate of incorporation or any amendment thereof. The registered office and/or resident agent may change from time to time. Any such change shall be made in accordance with the Articles of Association or, if different from the Articles of Association, in accordance with the provisions of this Agreement. If the Resident Agent ever resigns, the Company shall immediately appoint a successor Agent.

:max_bytes(150000):strip_icc()/stained-glass-artist-working-in-studio-687775085-5ab424123de4230036e62c50.jpg?strip=all)

Llc Operating Agreement

A Member may make such Capital Contributions (each a “Capital Contribution”) in such amounts and at such times as the Member determines. will be a member

Simple operating agreement for single member llc, multi member llc operating agreement, free operating agreement for single member llc, single member llc operating agreement, colorado single member llc, single member llc operating agreement georgia, single member manager managed llc operating agreement, sample operating agreement for single member llc, two member llc operating agreement, single member llc operating agreement template, single owner llc operating agreement, llc operating agreement colorado template