How To Calculate Cash Flow In Excel

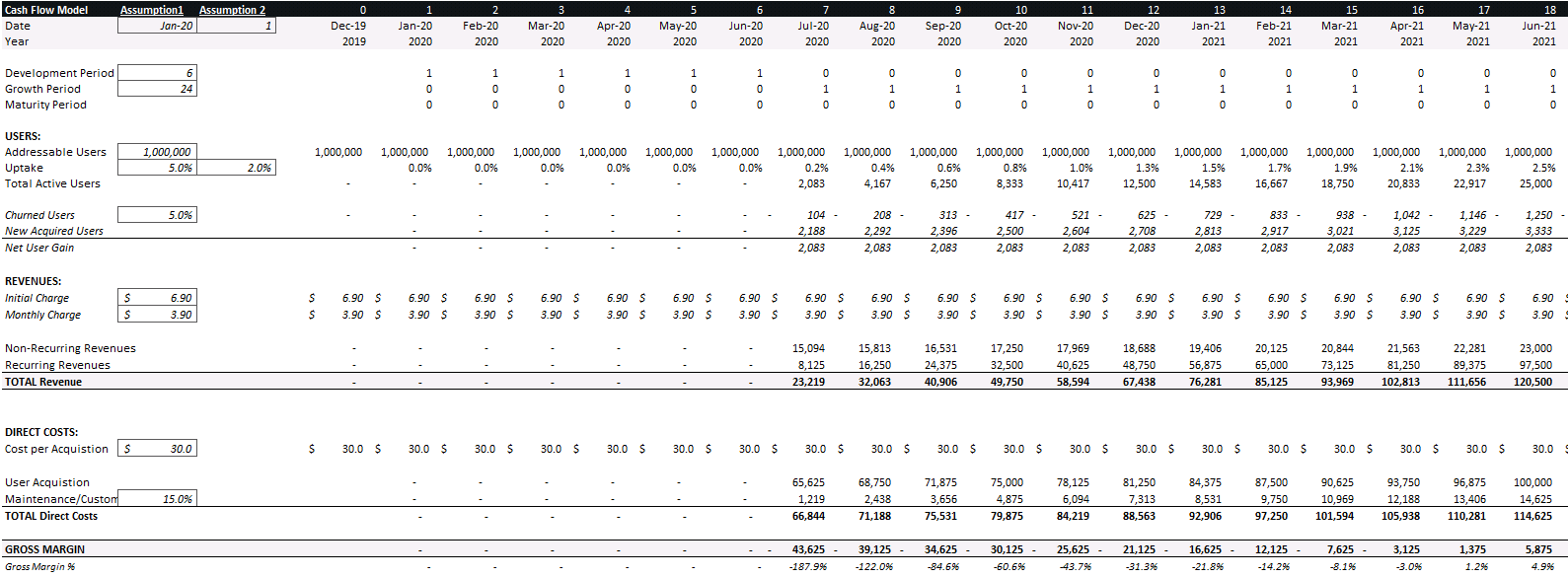

How To Calculate Cash Flow In Excel – Save your time. Connects directly to QuickBooks Desktop or QuickBooks Online to create a complete cash flow forecast that can be exported directly to a fully populated Excel template. Stop creating Excel templates by hand and export your fully populated cash flow template directly to Excel. Creates a complete Excel template with formulas that allow easy editing directly in Excel.

The Excel cash flow forecast template is fully populated with cash in and cash out transactions using QuickBooks Desktop or QuickBooks Online. The Excel template has built-in formulas that make it easy to add, remove, and edit transactions and see the impact on your bottom line right away.

How To Calculate Cash Flow In Excel

Not using QuickBooks Desktop or QuickBooks Online? Download the Cash Flow Forecast Excel template where you can fill in the data manually.

Solved Use The Income Statement And Balance Sheet To Prepare

Enter a known outstanding invoice, invoice amount and payment date. These are invoices already recorded in QuickBooks.

Enter specific recurring traffic, amounts and expected payment dates. These are all threads you can expect to see over the next few weeks.

Enter known outstanding bills, bill amounts, and payment due dates. These are accounts already saved in QuickBooks.

Structure Of A Corporate Model

Enter specific recurring expenses, amounts, and the bill’s due date. This is all the expenses you expect to incur in the next two weeks.

Uses state-of-the-art security measures, including bank-grade 256-bit SSL encryption. We maintain a strict information security policy to ensure that your data is always protected.Cash Flow Statement (CFS)Cash Flow Statement (Part 1)Cash Flow Statement (Part 2)Why is the Cash Flow Statement important?Net Cash Flow

Cash flow from operating activities Depreciation Amortization of intangible assets Change in net working capital (NWC) Accounting for capitalized software costs Salvage value

Determine The Proceeds Required To Achieve A Specific Irr

A cash flow statement tracks actual cash inflows and outflows from operating, investing, and financing activities over a period of time.

The cash flow statement or “cash flow statement” refers to the three main financial statements along with the income statement and the balance sheet.

The importance of the statement of cash flows (CFS) depends on the reporting standards established at the time of calculation.

Solved 1. Calculate The Operating Cash Flow And Networking

The net income shown on the income statement—the accrual-based “bottom line”—may not accurately reflect what’s happening with the company’s cash.

Therefore, a cash flow statement is necessary to compare net income to adjust for the following factors:

In practice, the actual cash flow during the period under consideration is reflected in the cash flow statement – which focuses on operational shortfalls and investments/financial services that are not reflected in the income statement.

Cash Flow Forecast Google Sheets Template

The impact of non-cash additions is relatively small as they have a net positive effect on cash flows (eg tax savings).

Focusing on net income without considering actual cash inflows and outflows can be misleading because accrual income is easier to manage than cash. In fact, a company with stable net income may even go bankrupt.

The statement of cash flows (CFS) can be presented in two ways: 1) indirect and 2) direct.

Consolidating Cash Flow Statement

If the three parts are added, we get the net change in cash for the period.

The net change in cash is then added to the beginning cash balance to calculate the period-end cash balance.

Here, CFS overcomes the shortcomings of accrual accounting, which determines cash inflows and outflows over a period of time using cash accounting, i.e. i.e. by tracking cash flows into and out of the company’s operations.

Monthly Cash Flow Statement With Current And Prior Month Figures

Below is a real example of a cash flow statement prepared by Apple (AAPL) under GAAP accounting standards.

If there are opening and closing balance sheets, the cash flow statement (CFS) can be combined (even if not explicitly stated) with the income statement.

Suppose we are given three financial statements of a company, including two years of financial data for the balance sheet.

Free M&a Excel Templates For Download

The completed cash flow statement that we calculate during the simulation is below.

Also, in the “Cash from Investments” section, the only line item is capital expenditures, which in year 1:

In addition, the only line item “Cash from financing” is the mandatory amortization of the debt (that is, the mandatory repayment of the principal amount):

Statement Of Cash Flow For A Nonprofit Organization

The beginning cash balance from the year 0 balance sheet is $25 million. USD, and we add the change in year 1 cash to calculate the ending cash balance.

After adding 3 million USD cash change to 25 mln. USD initial balance, we calculate 28 mln. USD as final cash.

28 million in the 1-year balance. The USD of ending cash that we just calculated in CFS goes into the current period cash balance account.

Making A 3 Variable Dcf Sensitivity Analysis In Excel

Operating assets decreased by 5 million. USD, and operating liabilities increased by 15 million. USD, so the net change in working capital increased by 20 million. USD calculated by our CFS and included in the cash balance calculation.

For our fixed assets, year 0 PP&E was $100 million. USD, so the 1-year value is calculated by adding Capex and subtracting depreciation to the previous period’s PP&E amount.

In addition, the balance of our company’s long-term debt is 80 million. USD, which is reduced by 5 million. USD mandatory amortization.

Cash Flow Forecast Excel Template

After the assets and liabilities of the balance sheet, only equity remains.

Common Shares and Additional Paid-up Capital (APIC) are unaffected by CFS, so we extend the Year 0 amount by 20 million. USD up to 1 year.

The year 0 retained earnings formula is a “switch” to keep the accounting equation correct (ie assets = liabilities + equity).

Bakery Financial Model Excel Template

However, the retained earnings balance for year 1 is equal to the previous year’s balance plus net income.

Note that if dividends are paid to shareholders, the amount paid will be from retained earnings.

:max_bytes(150000):strip_icc()/02-how-to-calculate-IRR-in-Excel-02cae499a78942e1b9b1888b21c18ae5.jpg?strip=all)

In the final step, we can confirm that our model is correctly constructed by checking that both sides of the balance sheet in years 0 and 1 are balanced.

How To Calculate Return On Investment (roi)

Sign up for the Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program is used at the best investment banks.

:max_bytes(150000):strip_icc()/Clipboard01-618bfd11c29a4e2dbd2a50ea127f34d1.jpg?strip=all)

We are currently sending the requested files to your email address. If you do not receive an email email, please check your spam folder before requesting the files again.

Get instant access to video tutorials taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Present value (PV) is the present value of expected future cash flows. The present value can be calculated relatively quickly using Microsoft Excel.

Solved] What Formula Do You Use In Excel To Solve This Problem Find The…

Some key things to remember when using PV formulas are that any cash paid (disbursed) must be a negative number. Income (earnings) are positive numbers.

While you can calculate PV in Excel, you can also calculate Net Present Value (NPV). Present value is the discounted future cash flows. Net present value is the difference between the PV of cash inflows and the PV of cash flows.

The big difference between PV and NPV is that NPV takes into account the initial investment. The NPV formula in Excel uses a discount rate and a series of cash flows and inflows.

Cash Flow Excel Template: Forecast Your Cash Flow

If you think you’ll have $50,000 in the bank in 10 years at 5% interest, you can determine how much to invest today to get there.

In Excel, you can label cell A1 as the year. Also, enter the number of years (10 in this case) in cell B1. Label cell A2 as “interest rate” and enter 5% (0.05) in cell B2. Now check Future Value in cell A3 and enter $50,000 in cell B3.

The built-in PV function can easily calculate the current value based on the information provided. Enter “Present Value” in cell A4, then enter the PV formula in B4, =PV(rate, nper, pmt, [fv], [type]), which in our example is “=PV(B2, B1, 0, B3).

Discounted Cash Flow Model (dcf) Excel Model

Since there are no interim payments, 0 is used for the PMT argument. The present value is calculated as ($30,695.66) because you need to deposit this amount into your account; it is considered a cash flow, so it appears negative. If a future value is specified as the output, Excel displays the current value as the input.

The Excel PV formula must be adjusted if the interest rate and payment amount are based on different time periods. A popular change required to create a PV formula in Excel is to change the annual interest rate to a compound interest rate. This is done by dividing the annual rate by the number of annual periods.

For example, if you pay monthly for the PV formula, you must convert the annual interest rate to a monthly rate by dividing by 12. Also, the NPER is the number of periods if you collect the payment. monthly annuity payment for four years, the NPER is 12 times 4 or 48.

Present Value (pv)

Present value uses the time value of money

:max_bytes(150000):strip_icc()/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg?strip=all)

How to calculate net cash flow in excel, how to calculate projected cash flow, how to calculate discounted cash flow in excel, how to calculate cash flow, how to manage cash flow in excel, how to calculate irr in excel for monthly cash flow, cash flow template in excel, cash flow models in excel, calculate discounted cash flow excel, calculate cash flow, how to calculate cumulative cash flow in excel, how to calculate expected cash flow