How To Calculate Net Cash Flow In Excel

How To Calculate Net Cash Flow In Excel – DCF spreadsheet in Excel. Calculate the value of future income. CAPM and exchange payment methods. Tables and graphs for printing.

Discounted cash flow (DCF) is a method of calculating the present value of future income based on the cost of money. Our Rebate Calculator in Excel will help you calculate the cost of your investment and calculate how much it will cost in the future.

How To Calculate Net Cash Flow In Excel

In short, the time value of money is considered to be one dollar in the future, which is less than it is today. Because the reason you should invest a dollar today is to bring more value.

Cash Flow Basics: How To Manage, Analyze, And Report Cash Flow

Example: Suppose the annual interest rate is 10%. If you put it into a savings account today, $1 in a year will turn into $1.10. This also means that $1 in the future paid or received in one year is equal to $0.91 today. In short, at an interest rate of 10%, the present value of $1 in the future is $0.91.

In fact, you can use the same concept to value an investment or an entire company. It is used to evaluate both investments (equity or debt) and business investments.

If the current value of the money is lower than the price to be paid or should be paid by the trader, the trader is in a better position. This is because he has the opportunity to earn more money than he spends. Of course, the effectiveness of this assessment depends to a large extent on the accuracy of its results.

Easy To Use Net Worth Spreadsheet (template For Google Sheets & Excel)

The discount rate should reflect the opportunity cost for the investor, in other words, if he decides to put his money elsewhere. The problem, however, is that there are many investment opportunities with reasonable returns.

Let’s assume that the appropriate rate of return should reflect the risk associated with the investment. The greater the risk involved in the investment, the higher the interest rate should be charged.

Market value is often used as a substitute for the discount rate when a company evaluates its value. It is generally accepted that a company’s weighted cost of capital (WACC) already takes into account the risks associated with the company’s operations.

Monthly Cash Flow Forecast Model (excel Template)

The Excel Discounted Cost Model calculates the WACC based on historical financial data as well as Fig. Asset Value Model.

Most companies finance their operations with various combinations of equity and debt. While it is relatively easy to determine the value of debt, this is not the case in the capital sector because, unlike debt, equity does not have a clearly associated value.

If a company regularly pays dividends, the cost of equity can be calculated by dividing the dividend by the share price. However, distribution rules are not consistent between companies, and some companies do not pay at all. In such cases, the only available option to determine the cost of equity is to use the Capital Asset Pricing Model (CAPM).

:max_bytes(150000):strip_icc()/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg?strip=all)

Need Help And All Excel Work Shown With Formulas !!

In the WACC section, select the cost of equity calculation method in the Assumptions subsection as stated above. Please enter your income tax rate. This will impact WACC and free cash flow estimates as well as development cost.

If you have chosen to use CAPM in this discount financial model, you must enter the model parameters:

Fill in historical data on equity, interest, market value of debt and expenses. The DCF model will calculate the after-tax cost of debt by dividing the market capitalization of the debt minus the tax impact.

What Is Cash Flow From Investing Activities? (cfi)

According to your method, this discounted cash flow Excel tool can calculate the cost of equity by dividing dividends by the stock market or by using the CAPM model. WACC is equal to the average cost of equity and debt weighted by the market value of equity and debt.

You can add calculated interest rates and enter your personal information manually. Then you can go to the Cash Flow section.

First, enter historical data (from the income statement) with estimates for the current year. You must enter data for at least three consecutive years, including the most recent information. You can use the blue color to predict future income.

Cash Flow From Financing Activities

In this Excel tool Cash flow projection is calculated automatically, but you can enter any values manually. Unless you enter a user reference price, that price will be applied to future payments.

Additionally, the projected cost of capital for the next 10 years is shown using WACC. The residual value represents the present value of cash flows in 10 years.

To arrive at the company’s market capitalization, the estimated present value of future cash flows (business value) is adjusted for outstanding debt and cash on hand (deposits and on hand). Finally, dividing the market capitalization by the number of shares traded gives an approximate value.

Discounted Cash Flow Excel Template Free: Financial Statements And More

Discounted Cash Flow is a ready-to-use Excel template, available now. If you want to customize your reports or require more complex models, please contact our custom services.

Watch the video below to see the model in action! The presentation also includes user information, information, and tips and tricks for the model. Intrinsic Value Time Value of Money (TVM) Present Value (PV) Future Value (FV) Growth Opportunity Present Value (PVGO) Adjusted Present Value (APV) Net Present Value (NPV) Interest Interest Interest Interest Interest

DCF model Valuable gradationEBIATNOPATFair cash flows NOPLAT Depreciation Amortization Annuities Action-based compensation in DCF Standard DCF model Leveraged DCF standard Standard DCF model Target soccer field design.

How To Calculate An Irr In Excel: 10 Steps (with Pictures)

Financial Discount Rate WACC Sales Price (ke) Capital Asset Pricing Model (CAPM) Beta (β) Equity Risk Premium (ERP) Cost of Debt (kd) Oloto Rate (rf) Professional Trading Price (kp) Business BetWACC for private companies

Operating cash flow (OCF) measures the cash flow from a company’s main operations over a specific period of time.

OCF, short for “cash flow”, refers to the amount of cash a company brings in each day.

Easy To Use Cash Flow Statement Template

The income statement is reported in accordance with accounting standards established by US GAAP, which typically do not reflect the actual liquidity of the company (e.g., cash on hand).

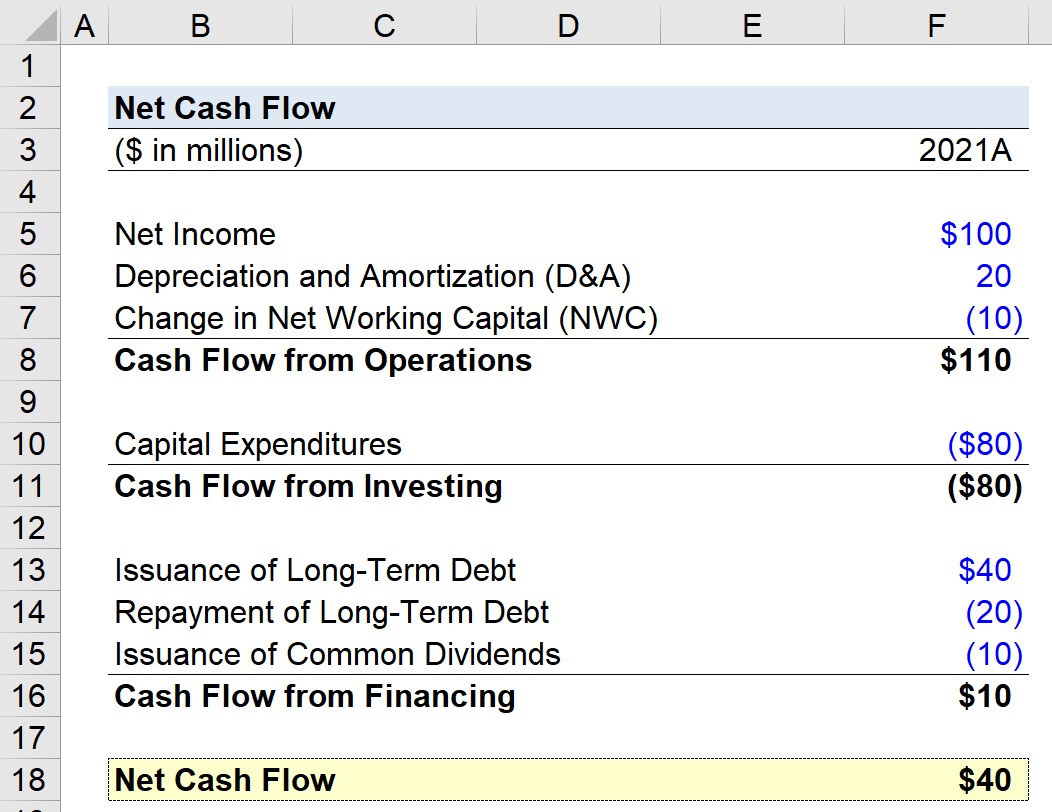

Therefore, a cash flow statement (CFS) is needed to understand the actual cash inflows/(outflows) from operating, investing and financing activities.

The CFS begins with the “Operating Cash Flow” section, which outlines the use of the company’s cash flow (OCF) for a specific period.

What Is Cash Flow Per Share?

In the good OCF example, the company’s operations generate enough cash to meet its reinvestment needs, including working capital and working capital (CapEx).

But in the latter case with a negative OCF, the company must find external financial resources to meet its reinvestment needs, e.g. by issuing shares and debt.

Cost accounting (CFS) can be provided in two ways – indirect or direct:

How To Use Discounted Cash Flow, Time Value Of Money Concepts

Under the indirect method – the most common method in the United States – the top position of the CFS is the income fund.

If OCF is significantly different from net income, more research is needed to understand the factors that make the difference.

For example, if the OCF is lower than revenue due to an increase in revenue (A/R) – meaning customers were paying for sales with credit instead of cash – perhaps the company should review how it collects payments from customers.

How To Create A Financial Model With Debt Financing

The default OCF calculation method is the direct method, which uses measures to track cash flows over a specified period.

Compared to the indirect method, the direct method is simpler because the measure is to subtract expenses from income.

Operating cash flow (OCF) and free cash flow (FCF) are ratios used to assess a company’s financial stability, usually to determine if it has enough cash flow to cover its expenses.

Monthly Cash Flow Worksheet For Personal Finance

While there are many variations of calculating free cash flow (FCF)—namely, free cash flow to business (FCFF) and free cash flow to equity (FCFE)—the simplest calculation is to subtract expenses (CapEx) from cash from operations (CFO).

The difference between FCF and CFO is that FCF also deducts CapEx as large cash flow is a key component of a company’s ability to make money.

For each metric, the higher the number, the better the company (and vice versa), but the FCF goes a step further by considering Capex.

Discounted Cash Flow Excel Template

The depreciation amount is a non-cash addition (since the actual cash, CapEx, was already present during the initial purchase), so it has a positive effect on cash flow.

NWC growth reflects more cash tied up in operations; then the cash flow decreases.

If we put these assumptions on the OCF scale using the indirect method, we get $45 million OCF for our sample company.

Typical Cash Flow Waterfall (excel Template And Pdf Manual)

Cash receipts refer to payments received from customers and two expenses (discounting cash) include:

Putting the assumptions into our OCF formula with the right approach, our company’s OCF is USD 45 million.

Eligible for Special Package: Learn Financial Statements, DCF, M&A, LBO and Comps. The same training program used in the best banks.

Solved Problem 3: For The Net Cash Flow Series Shown: A)

We are now sending the requested files to your email address.

Net cash flow excel, calculate net cash flow, how to do cash flow in excel, how to calculate irr in excel for monthly cash flow, how to calculate the net cash flow, how to manage cash flow in excel, how to forecast cash flow in excel, how to calculate free cash flow from net income, how to calculate cash flow, calculate discounted cash flow excel, how to calculate cash flow in excel, how to calculate discounted cash flow in excel