How To Calculate Percentage Rate Of Interest

How To Calculate Percentage Rate Of Interest – Your Annual Percentage Rate (APR) is the interest rate you pay each year on your loan, credit card or other type of debt. Borrowing money from a business has a cost. Banks and other financial institutions pay a percentage of the money borrowed from them to make a profit. The APR is a percentage of your total balance.

When you borrow money, it’s important to remember that the cost of the goods or services you bought with that money will increase with interest. Most of us know how to borrow money in the form of a credit card. Knowing your APR will help you make better decisions about your loans and credit cards and remind you that you’re getting the right amount for the best deal.

How To Calculate Percentage Rate Of Interest

APR is the total cost of borrowing from a bank or financial institution for one year. It takes into account all types of fees associated with borrowing money, such as late fees, additional fees, handling fees, etc. This is a good way to calculate the total cost of the loan.

Rd Sharma Solutions For Class 8 Chapter 14 Compound Interest Download Free Pdf

In other words, the APR of a secured loan is the total amount of interest paid each year, expressed as a percentage of the loan. For example, if a credit card has a 10% APR, you’ll pay $1,000 a year for every $10,000 you borrow. However, keep in mind that the APR does not take into account the compounding effect of interest.

APR is used to compare the cost of borrowing money from different lenders. All things being equal, the credit card or line of credit with the lowest APR will cost you less.

However, the most important thing to consider is the “grace period” associated with your credit card (or other credit). Grace periods, with most credit cards, allow you to avoid paying a fee on your credit card if you can pay off your balance in full each month.

Calculate The Terms Of A Loan

With this in mind, grace periods can help you avoid APR fees. It’s always a good idea to check with your credit card issuer to determine the terms of your grace period.

Generally, credit cardholders can pay their bills in full on time without being affected by the APR. The APR is based on the outstanding balance, so if the card is paid in full when the balance is due, the APR will not apply.

To begin with, you need to consider the principal amount, the number of years the loan will be in existence, and any additional costs associated with the loan, other than interest.

How Is Credit Card Interest (apr) Calculated?

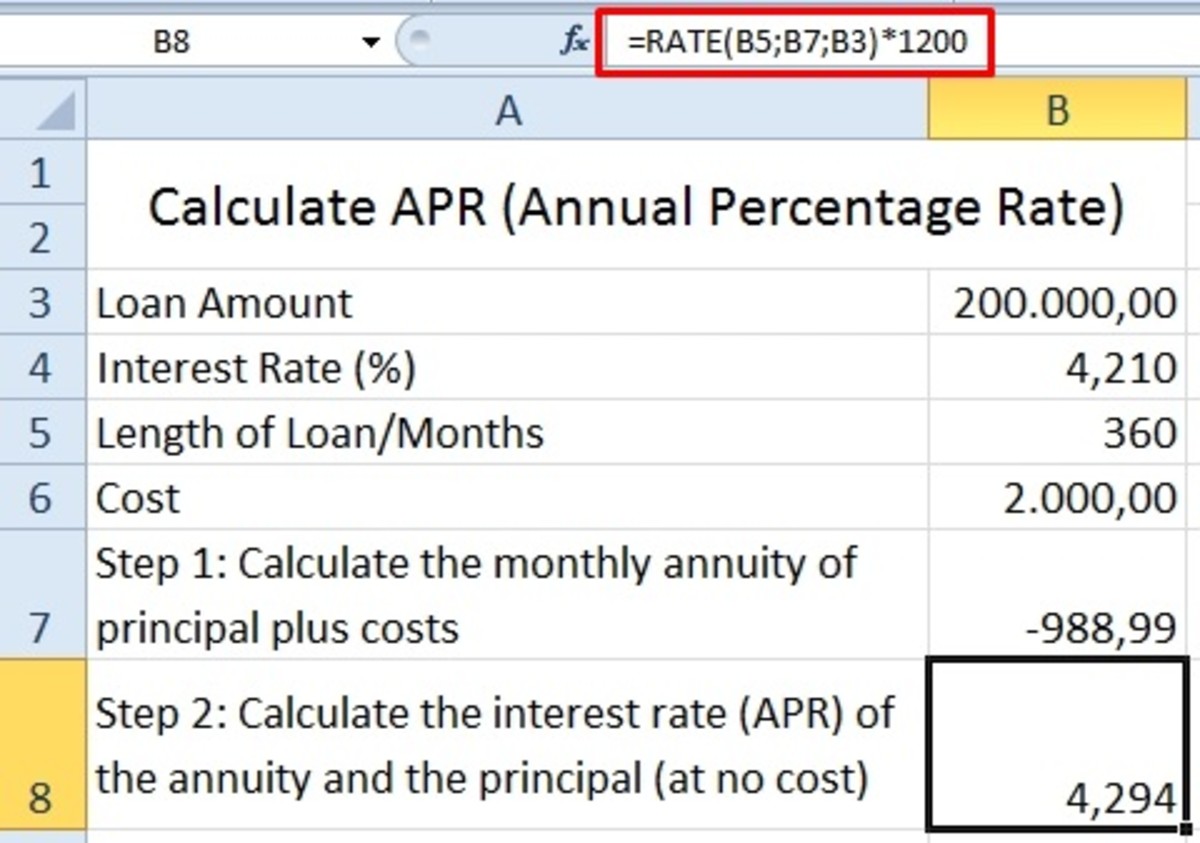

The formula to calculate APR looks like this: APR = (Payment + Interest) x 1 year x 100 / Principal amount times the loan

You borrow $2,000 at 5% interest for two years. Administrative fees up to $200. To find your APR, first, you calculate the interest on the loan using the following formula: A = (P(1+rt)) A = total amount borrowed, P = principal amount, r = interest rate, t = time period . Following our example, P = $2000, r = 5%, and t = 2 years. So, A = (2000 (1+0.05×2)). Solving this, we get A = $2,200. Profit = A – P. $2200 – $2000 = $200, so interest = $200. In the next step, you add this interest to the operating costs (fee + interest in the APR formula). Operating expenses are $200, so $200 + $200 = $400. In the last step, you divide the principal amount by the number of times. Then you multiply that by one and 100 to get a percentage. APR = (400/2000) / 2 x 1 x 100 = 10% Now we know that the APR for this loan is 10%

These calculations can help find the right cost of debt. At first it seems that the interest on this loan is only 5%, but after calculating all the costs, it turns out that this amount is 10% per year.

How To Calculate The Apr Of A Loan

Credit card APRs depend on payments made. For example, your lender may charge one APR for balance transfers from another card, a second APR for purchases, and a third APR for cash advances. It’s also likely that your lender has APRs set at higher rates for customers who break the terms of their cardholder agreement or don’t pay their balances on time.

Some credit card companies may use an introductory APR as a marketing ploy to encourage signing up for their cards. These APRs are low or 0%, in an effort to attract new customers.

Your specific APR is mainly based on your credit score. Those with good credit are offered loans at lower interest rates than those with bad credit.

How To Calculate Monthly Interest

Unfortunately, if you are unable to repay the loan on time, the interest rates on the loan will increase. Because you’ll find yourself with more liability to the financial institution (and more leverage, but that’s a discussion for another day).

Typically, loans come with either a fixed APR or a variable APR. The main difference between the two is that a fixed APR loan has an interest rate that does not change and a variable APR loan has an interest rate that can change at any time.

With a fixed APR loan, the interest rate applied to the principal is fixed and does not change. This means that the APR you calculate based on your interest rate will not change. The amount paid each year on the loan remains at the same rate.

Present Value Of An Annuity: How To Calculate & Examples

With a variable APR loan, the interest rate changes in the principal amount over time, and the APR changes with it. This change depends on changes in the US interest rate and other indicators. The borrower will pay more if the interest rate increases.

Usually, credit cards come with a variable rate, but some cards, like store cards, have a fixed rate. Although the fixed rate is subject to change, there is a policy that states how many days in advance you must be notified before this change occurs.

While APR is great for calculating the total cost of a loan, it’s not the best system when comparing loans. Some disadvantages with APR include:

Calculate Simple Interest Principal, Rate, Or Time

You may find yourself in a situation where your loan is not calculated based on the flexible interest rate. For example, if your interest is compounded, as is the case with long-term loans such as mortgages and student loans, the APR calculation may not be as straightforward. This is because these funds are not based on simple financial models.

If you want to calculate the interest on the loan while taking into account the compound interest rate, you should use the annual percentage rate (APY) instead of the APR.

APY is also the amount earned on the deposit, taking into account compound interest. APY tells you how much money your savings or investments will earn over a period of time.

What Is Simple Interest?

APY is meant to measure what a lender earns when investing in an area and count how many times the investment is compounded.

A nominal interest rate is the same as a false interest rate. It represents the interest rate without accounting for inflation and is not used in official calculations by financial institutions. To get the real interest rate, you need to adjust the nominal interest rate for inflation.

Using interest rates means creating a base interest rate that can be calculated to determine the interest rate. It is usually the interest rate that banks use in advertising and promotional materials.

A Bank Pays Interest By Continuous Compounding, That Is ,by Treating The Interest Rate As The

If you make an investment or deposit in a bank, the amount you make for this investment is determined by the real interest rate. The real interest rate is, again, the nominal rate adjusted for inflation. When this rate increases, it means more money for the investor, or when it decreases, it means less money for the investor.

The differences between the APR and the nominal interest rate are generally related to the factors involved in the calculations and how these calculations are used. The APR tells you the total annual cost of the loan, but the interest rate is used to determine how much money you’ll earn on the loan.

APR is generally a more effective tool because it is adjusted for inflation and takes into account other non-interest costs associated with borrowing. APR can help compare loans more accurately, but comparing interest rates can be misleading.

How To Calculate Cd Interest Correctly

APR can be a useful tool in determining how much you should pay for a loan. However, APR has some weaknesses as a benchmarking tool, especially as a single tool

How to calculate bond interest rate, how to calculate cd interest rate, how to calculate interest rate per month, how to calculate saving account interest rate, how to calculate bank interest rate, how to calculate mortgage interest rate, how to calculate interest rate per year, how to calculate interest percentage rate, how to calculate my interest rate, how to calculate fixed interest rate, how to calculate variable interest rate, interest rate how to calculate