How To Do Cash Flow In Excel

How To Do Cash Flow In Excel – Trend-based cash flow statements are considered important monthly financial reports and are used by CFOs and accountants to analyze trends in cash flow and cash inflows. Some of the key features of this type of trend report is that it will dynamically display the last 13 months based on the month the user is running the report. In other words, it is a sliding, trending cash flow. The example given is formatted as an indirect cash flow statement. Below you will see an example of this type of trend report.

Non-profit organizations and associations use the statement of cash flows to monitor trends that affect the organization’s cash position. When used as part of good business practices in the financial planning and analysis (FP&A) department, companies can improve their liquidity as well as reduce the risk of a cash crunch.

How To Do Cash Flow In Excel

Advanced Financial Planning & Analysis (FP&A) departments sometimes use various statements of cash flows, including balance sheets, statements of operations, financial dashboards, budgets, forecasting models, and other management and control tools.

Present Value (pv)

Actual data (historical transactions) from Enterprise Resource Planning (ERP) systems: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intact, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Acumatica, Netsuite etc.

In analytics that use budgeting or forecasting, planning data often comes from internal Excel spreadsheet models or enterprise performance management (CPM/EPM) solutions.

Https:///wp-content/uploads/2020/12/nonprofit_16-scaled-1.jpg 1438 2560 Nils R. https:///wp-content/uploads/2019/10/solver-logo-final.png Nils R. 2020-12-14 09:32:27 2021-02-14 02:46:52 Statement of Cash Flows for Non-Profit Organizations Present value (PV) is the present value of expected future cash flows. Present value can be calculated relatively quickly using Microsoft Excel.

Free Cash Flow To Firm (fcff) Excel Model

A few keys to remember for the PV formula is that the cash in (outflow) must be a negative number. Money (income) is a positive number.

While you can calculate PV in Excel, you can also calculate Net Present Value (NPV). Present value is the discount of future cash flows. Net present value is the difference between the PV of cash flows and the PV of cash flows.

The key difference between PV and NPV is that NPV considers the initial investment. The NPV formula for Excel uses discount rates and levels of cash flows and cash flows.

Consolidating Cash Flow Statement

If you expect to have $50,000 in your bank account 10 years from now, and the interest rate is 5%, you can find the amount invested today to reach that goal.

You can label cell A1 in Excel “Year”. Also, in cell B1, enter the number of years (10 in this case). Label cell A2 “Interest Rate” and enter 5% (0.05) in the cell. Now in cell A3, name it “Future Value” and enter $50,000 in cell B3.

The built-in PV function can easily calculate the present value using the given data. Enter “current value” in cell A4, then enter the PV formula in B4, =PV(rate, nper, pmt, [fv], [type]), which in our example is “=PV(B2, B1, 0,”). B3).”

How To Forecast Cash Flow In Excel

Since there is no payment intervention, 0 is used for the “PMT” argument. This amount is calculated as a present value ($30, 695.66) as you have to put it in your account; This is considered a cash flow and is therefore shown as negative. If the future value is shown as an outflow, Excel will show the current value as an inflow.

For the PV formula in Excel, adjustments must be made if the interest rate and payment amount are based on different periods. A popular change required to make the PV formula work in Excel is to convert the annual interest rate to a period. This is done by dividing the annual rate by the number of periods per year.

For example, if your payment for the PV formula is made monthly, you need to convert it to monthly by dividing your annual interest rate by 12. Similarly, for the NPER, if you collect monthly payments for four years, the NPER is 12 times 4, or 48.

Monthly Cash Flow Worksheet For Personal Finance

Present value uses the time value of money to discount future cash flows or cash flows to present value. This is because money today has more purchasing power than the same amount in the future. Taking the same logic in a different direction, future value (FV) takes the value of money today and predicts what its purchasing power will be at some point in the future.

Present value is important for determining the present value of an asset or investment that has income or cash flows that will be sold or paid in the future. Since the transaction takes place in the present, future cash flows or returns must be considered, but today’s value of money is used.

Calculating present value is very common. Interest-bearing assets, such as bonds, annuities, leases, or real estate, are priced using present value. Stocks are often priced based on the present value of future earnings or dividend streams using cash flow analysis (DCF).

Free Cash Flow Statement Templates

By clicking “Accept all cookies”, you agree to store cookies on your device to improve website navigation, analyze website usage and assist in our marketing efforts. Cash Flow Statement (CFS) Cash Flow Statement (Part 1) Cash Flow Statement (Part 2) Why is the cash flow statement important? Net cash flow

A cash flow statement tracks the actual flow of cash from operating, investing, and financing activities in each period.

The statement of cash flows, or “statement of cash flows,” along with the income statement and the balance sheet represent the three main financial statements.

Cash Flow Calculator Excel And Google Sheets Template

The importance of the cash flow statement (CFS) is related to the reporting standards established under accrual accounting.

The net income shown on the income statement — the accrual-based “bottom line” — may not be an accurate representation of what happened to the company’s cash.

Therefore, the statement of cash flows is necessary to reconcile net income to adjust for factors such as:

Operating Cash Flow (ocf)

In fact, the statement of cash flows captures the actual movement of cash during the period in question – attracting the weakness of operations and investment / financing activities.

The effect of increasing non-cash funds is quite straightforward, as these have a positive effect on cash flow (for example, tax savings).

Focusing on net income without looking at actual cash flow is misleading because retained earnings are easier to manage than cash earnings. In fact, companies with constant net profits are likely to go bankrupt.

Pro Forma Cash Flow Template For A Restaurant (excel)

The two methods that the Statement of Cash Flows (CFS) can be presented are 1) the indirect method and 2) the direct method.

Adding the three categories together, we arrive at the “net change in cash” for the period.

Then the net change in the cash amount is added to the balance of the period.

Cashflow Analysis Excel Template

The shortcomings of the income statement (accrual accounting) are solved here by CFS, which determines the flow of cash over time while using cash accounting – that is, tracking the cash coming in and out of the company’s operations.

The following is a real-world example of a statement of cash flows prepared by Apple (AAPL) under GAAP accounting standards.

Assuming that the beginning and end of the period balance sheet is available, the statement of cash flows (CFS) can be combined (although not clearly stated) as long as the income statement is available.

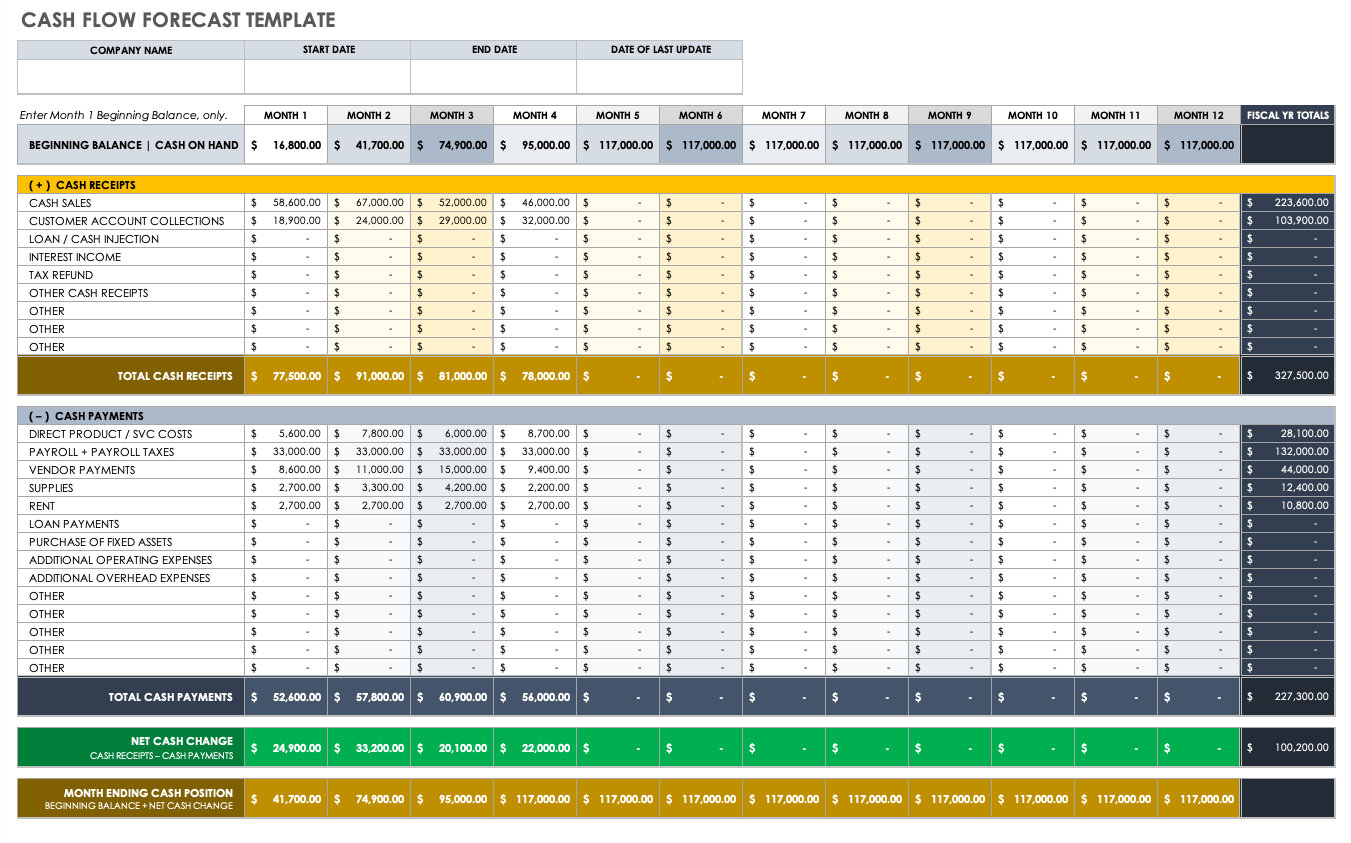

Monthly Cash Flow Forecast Model (excel Template)

Suppose we have received three financial statements of a company, including two years of financial information for the balance sheet.

Below is the completed statement of cash flows that we will be calculating throughout our modeling exercise.

Next, the only item in the “cash from investment” category is capital expenditure, which is expected in year 1:

Excel Template Cash Flow Forecast M15

Similarly, the item “Cash from financing” is only a mandatory debt payment (such as the payment of the principal amount of the debt):

The beginning balance we get from the Year 0 balance sheet equals $25 million, and we add the net change in Year 1 cash to calculate the ending balance.

Adding the $3 million net change to the beginning balance of $25 million, we calculate $28 million in ending cash.

Net Cash Flow

In the Year 1 balance sheet, the $28 million in cash at the end we estimate at CFS flows into the current period’s balance sheet.

Operating liabilities increased by $15 million while operating assets decreased by $5 million, so the net change in working capital increased by $20 million – which was calculated by our CFS and included in the balance sheet calculation.

For our long-lived assets, PP&E in year 0 is $100 million, so the value in year 1 is calculated by adding capex to the amount of PP&E in the prior period and deducting depreciation.

Cash Flow Excel Template: Forecast Your Cash Flow

Next, we calculate the long-term debt of our company

Cash flow management excel, cash flow projection excel, how to calculate cash flow in excel, cash flow in excel, cash flow planning excel, cash flow template in excel, cash flow tool excel, how to manage cash flow in excel, how to forecast cash flow in excel, how to do a cash flow analysis in excel, how to do a discounted cash flow analysis in excel, cash flow statement excel