Personal Financial Planning Worksheets India

Personal Financial Planning Worksheets India – We all have goals in life – things like starting a business, buying a house, getting married – but money issues often come in and prevent us from achieving these goals.

So we wish we had some financial plans to pay for necessities, cover life’s unexpected events… and still have enough left over to move toward our goals.

Personal Financial Planning Worksheets India

If any of this sounds familiar to you, you don’t have a financial plan.

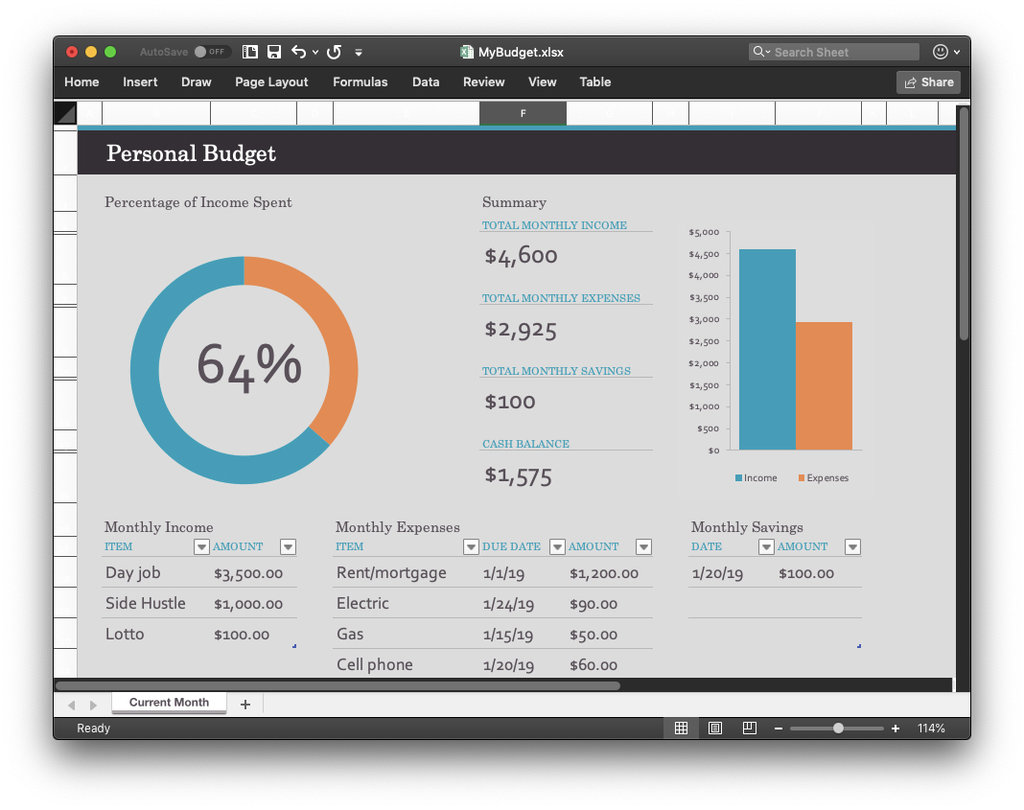

The 50/30/20 Rule Of Thumb For Budgeting

At its most basic, a financial plan helps you meet your current financial needs and provides a strategy for achieving future financial stability so you can move forward with your goals.

In this article, you will learn everything you need to know about financial planning. We’ll share 8 steps to help you create your own financial plan, as well as some templates to help you save money and time.

It takes into account your current financial situation and goals, then creates a comprehensive strategy based on your priority objectives, tells you where to spend your money and when to save.

Financial Advisor Resume Sample & Writing Guide (+ Skills)

In addition, a financial plan helps you prepare for the unexpected by putting money in a pot. In case of unexpected job loss, illness or economic downturn, you can rely on this fund to cover your daily expenses.

Basically, you can use financial planning to manage your money, which means you can reach your goals and ease any worries you may have about your well-being.

/cdn.vox-cdn.com/uploads/chorus_asset/file/20036974/moneyinexcel.jpg?strip=all)

In the past, people had to hire professionals to create financial plans for them. But with the advancement of technology, you can do it yourself.

Key Components Of Financial Literacy

It’s easy with a financial plan template that you can modify to reflect your own goals, cash flow, and more. In the article you will find some useful templates that you can use.

A personal financial plan is a documented analysis of your personal finances, including Your income, debts, assets and investments.

Its purpose is to assess the feasibility of your personal goals and understand the level. When you want to achieve them – financially.

:max_bytes(150000):strip_icc()/50-30-20budgetingrulecustomillustration-9973713c9be846c1b25b7bf372b4818d.png?strip=all)

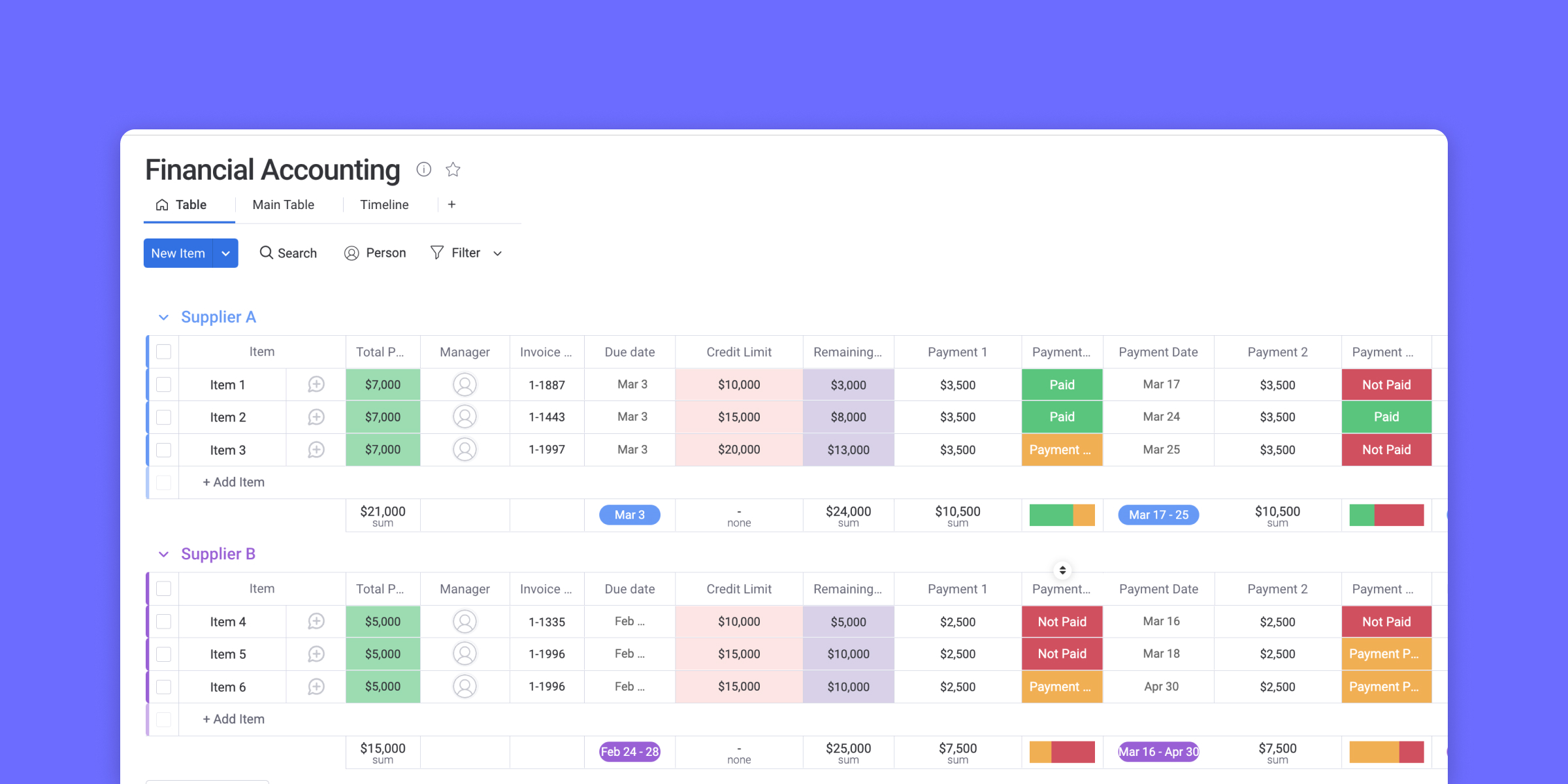

The Ultimate Excel Accounting Template For Bookkeeping

Your personal finance plan can stretch out over weeks, months, or years based on the estimated completion time of your goals. And it can be modified at any time to reflect new or changing priorities.

Creating a financial plan can give you more confidence in your finances. Plus, it means less time at night worrying about those pesky bills.

The problem is, many people do not know where to start. “How much will the financial plan cost?” They worry about things like assuming they need endless professional support.

Accounts Executive Resume Examples & Template (with Job Winning Tips)

Good news? It’s never too late (or too early) to start working on your financial plan. Even better – creating a financial plan is not as complicated as you think. You can break it down into 8 simple steps:

Before starting the actual “planning” of the process, you need to know where your journey will begin. That means you need to look at what your financial situation is right now.

Honestly, everyone could benefit from investing in frequent financial audits, but it’s easy to overlook your bank account.

How To Create A Personal Financial Plan (and Reach Your Goals Faster)

Think about it – when was the last time you looked at your gas, electricity, broadband and Netflix bills and discovered what they added up to?

Take your last 6 to 12 months of bank statements and highlight regular expenses in each color, then highlight your irregular expenses in another.

It is useful to classify these expenses as personal and “critical” expenses. When you have all the right information in front of you, ask yourself:

Free Investment Tracking Spreadsheets 💰 (excel) ᐅ Templatelab

The next step is to figure out where you are going. This is an important part of your “Financial Planning for Dummies” journey.

![]()

Setting firm goals gives you direction and clarity when making decisions about your finances. Your goals will show you if you are going in the right direction.

Don’t just say you need more money in your savings. Write a statement describing what you want to achieve:

:max_bytes(150000):strip_icc()/financial-advisor-career-information-526017_final-9c1362c7706146ada8c9173002ddee69.png?strip=all)

Tiller: Your Financial Life In A Spreadsheet, Automatically

A short-term financial goal like “I will put $100 into my savings next month” will motivate you by showing consistent progress. Long term goals give you a more stable direction to move towards.

No one likes to think about debt – but if you want financial stability, these are issues you can’t ignore. A personal financial plan can help.

If your interest and repayments are holding you back, you won’t be making much progress with your short-term and long-term goals. So first find out how to pay off your debt.

Personal Finance Excel Spreadsheet Templates For Managing Money

Start by creating a plan to get rid of your most pressing debts. These are high spending costs due to high interest rates and fees. Get rid of them as soon as possible.

If you are struggling to deal with multiple debts at the same time, it may help. See if you can combine all into one, cheaper loan.

The bottom line is that you need to take action and stay debt free. Remember that debt includes immediate issues, credit cards, long-term expenses, student loans, and more.

Simple Financial Projections Templates (excel,word)

No matter how “prepared” you think you are, there is a chance that an unexpected expense will come and sweep you off your feet.

An emergency fund protects you from unexpected illness, sudden job loss, or bills you forget to pay.

Although the amount of emergency fund you have is up to you, it should cover 3 to 6 months of your fixed expenses. Save enough for expenses such as entertainment and food.

Hr Budget Templates

An emergency fund is useful for everyone. However, they are especially important if you are a freelancer, have a bad credit score, or have a variable income.

Estate planning is one of those confusing terms that most people ignore – it only applies to the wealthy or those nearing retirement.

However, it is important to think about protecting your family while you are away. The right estate plan gives you complete peace of mind.

The 19 Best Free Google Sheets Budget Templates

Estate planning may not be the best thing you can do on your Friday evening, but it will get you covered.

The next step is to build on the wealth you already have so you are ready for tomorrow. Crooked. Start focusing on your savings and investments.

![]()

You can have different plans according to your short-term and long-term goals. For example, your short-term financial plan will cover the steps you will take to build wealth now. Your 5-year financial plan may look at things like retirement.

Budget Planning Templates For Excel

Investing for retirement is one of the best ways to ensure that you are prepared for the future. When you start planning for retirement, you should consider several variables:

If you are brand new to investing, look for some special help. There are wealth advisors who can advise you on different types of investment accounts and vehicles.

Just as an emergency fund protects you from life’s unexpected surprises, insurance protects your money from unexpected risks.

Best Free Retirement Planning Spreadsheets For 2022

With the right insurance, you won’t have to keep dipping into your savings every time something goes wrong. For example, home insurance means that you are properly protected from natural disasters and destruction.

Car insurance ensures that if something goes wrong with your car, you are prepared to fix the problem without paying a large sum of money.

Having an emergency fund and making sure you are properly insured means you can stay on top of all your savings goals.

Monthly Budget Templates In Google Sheets

The more you know about your current financial situation and where you’re going, the more confident you’ll be in your spending.

However, getting a sample financial plan and creating your own strategy is only the first step in the journey. You should also make a commitment to monitor your progress.

Check back every three months to make sure you’re moving in the right direction. A lot can change your financial situation within a few weeks.

Personal Finance Calendar

Don’t forget to update your plan when important events happen in your life as well. Having a baby, getting married or buying a new home will create new considerations for you to deal with.

Proactively reviewing and updating your plan means you can enjoy a bulletproof strategy to reach your financial goals.

There are several financial planning templates available to help you set up a financial plan. All you have to do is enter the details in their field. You can edit or delete fields based on the information you have.

Couples Budget Spreadsheet With Monthly Shared & Personal

Even if you don’t want to use a template, these financial plan examples are a good starting point to learn what a real-world plan looks like and the specific financials you should include in the document.

Assess your current financial situation, create a strategy to achieve your goals and use a plan to track progress.

Only Stacey’s Financial Planner can lay it all out for you – month by month

Free Business Plan Template And Examples For Startups (2022)

Personal financial planning services, personal capital financial planning, personal financial planning worksheets, personal financial planning jobs, personal financial planning software, online personal financial planning, personal financial planning app, personal financial planning certificate, personal financial planning course, personal financial planning worksheets excel, personal financial planning excel, personal financial planning