How To Find Sales Tax Percentage From Total

How To Find Sales Tax Percentage From Total – We use cookies. By using our website, you agree to our cookie policy. Cookie settings

This article was written by Gina D’Amore. Gina D’Amore is a certified public accountant and founder of Love Accounting. With 12 years of experience, Gina works with small firms in all areas of accounting, including finance and human resources. He holds a bachelor’s degree in economics from Manhattanville College and an accounting degree from MiraCosta College.

How To Find Sales Tax Percentage From Total

This article has 11 links, which can be found at the bottom of the page.

Chan Bought A $600 Computer, But His Total Was $648. What Percent Sales Tax Did He Pay?

It’s important to know how much something will cost before you buy it. It’s not as easy to look at the price tag as it is to calculate the sales tax to determine the total tax. As the sales tax rate rises, the impact of the purchase tax will be more pronounced. Use these tips to learn how to calculate retail sales tax.

This article was written by Gina D’Amore. Gina D’Amore is a certified public accountant and founder of Love Accounting. With 12 years of experience, Gina works with small firms in all areas of accounting, including finance and human resources. He holds a bachelor’s degree in economics from Manhattanville College and an accounting degree from MiraCosta College. This article has been viewed 2,211,499 times.

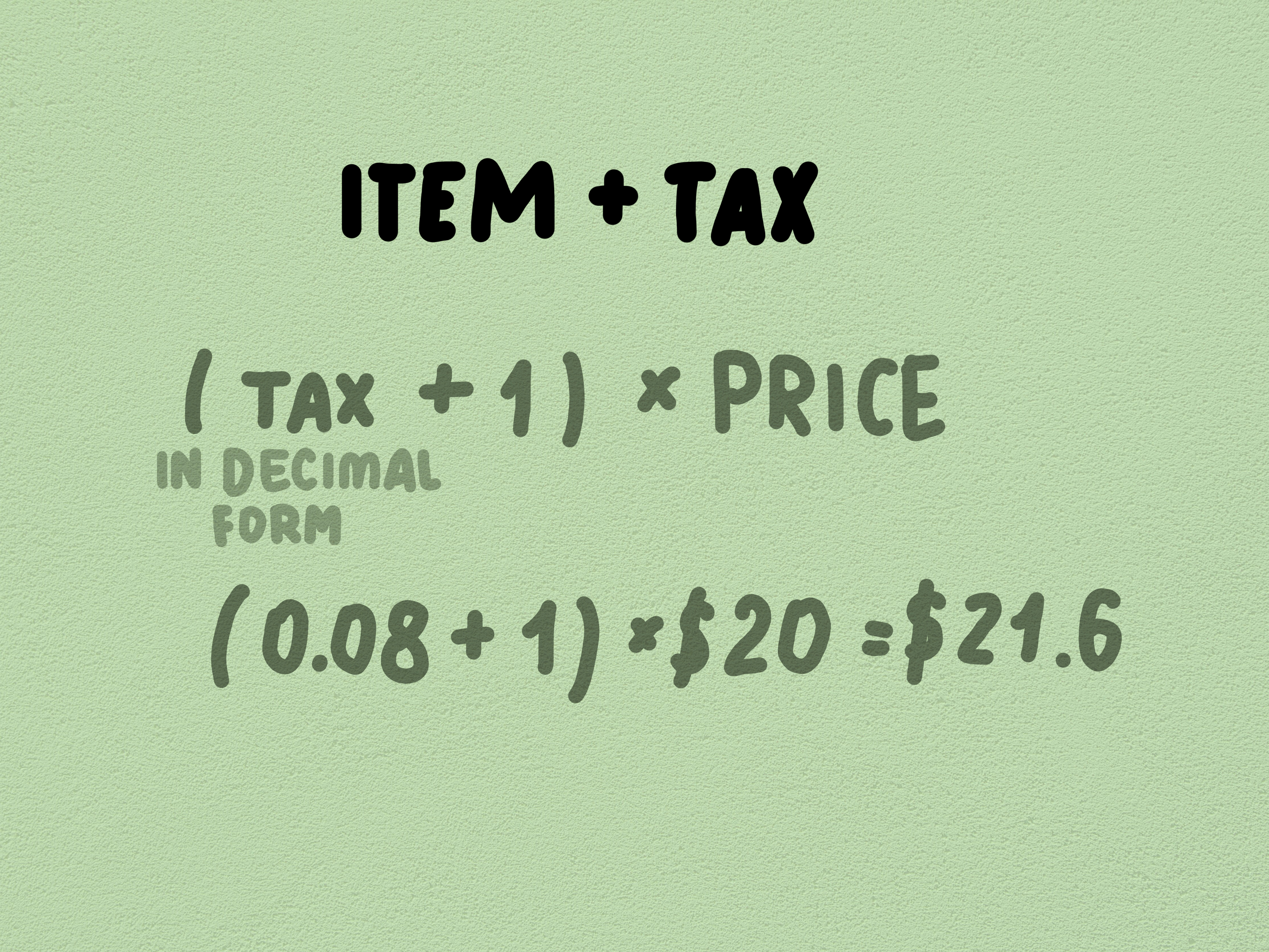

To determine sales tax on a particular item, you need to know your local sales tax rate. You can find this information by searching online for city and state sales tax rates. Once you know the tax rate in your area, change the sales tax rate from tenths to tenths by moving the decimal point two places to the left. Then multiply the resulting number by the item’s list price to determine the sales tax for that item. So you get a $27.95 purchase with a local tax rate of 8%. You multiply 27.95 by .08 to give you $2.24 in tax. Add this amount to the item price to find the total price including tax. In this case, the total amount would be $30.19. But what if you know the total value of the item after tax, and you want to determine the tax rate based on that? To do this, subtract the item’s list price from the total amount after tax. This will give you the amount of sales tax you paid. Then, divide the tax amount by the list price. To get the tax rate as a percentage, move the 2nd decimal point to the right. For example, if the list price is $72.50, if you paid $75.05, you paid $2.55 in tax. 2.55 divided by 72.50 is 0.035, which means the tax rate is 3.5%. Learn more about how to calculate sales tax, including some examples! Knowing how to calculate interest or percentage is a useful skill in everyday life. You calculate points, tips, taxes, rain chances and car expenses with interest. In science, percentages are used for errors and large scale calculations. Here’s a step-by-step guide that will show you how to find interesting and practical examples.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them

Percent means “percentage.” Represents the fraction of a number that exceeds 100% of the total number. The percent sign (%) or the abbreviation “pct” indicates a percentage. A percentage value can be written as a fraction of 100 (eg, 5% is 5/100) or as a decimal (5/100 is 0.05).

You have 9 marbles. Three of them are blue. What percentage of marbles are blue? What percentage of marbles are not blue?

There are two ways to find the proportion of non-blue marbles. The ratio of all marble colors must add up to 100%, so the easiest way is to get the blue marble’s ratio from 100%.

Plz Help This Is Due Tomorrow 20 Points If Correct!!!! Find The Sales Tax. Then Find The Total Cost

An easy way to calculate a plane doesn’t require multiplication. Move the decimal point to the left to get 10%, so $18.72 at 10.7% is $1.87. A 5% tip is half that amount, about 94 cents. Add a 10% tip and a 5% tip to get a 15% tip ($1.87 + $0.94).

The first step is to get 8.1% of $12.99. Remember, 8.1% equals 8.1/100, or 0.081.

A minimum of 60% coursework is required for the final exam. The final consists of 15 questions, all of equal size. How many people should pass?

Stripe Tax: Automate Tax Collection On Your Stripe Transactions

Calculate what 60% of 15 is. Remember that the fraction 60% is 60/100, or the decimal value 0.60. We use cookies. By using our website, you agree to our cookie policy. Cookie settings

This article was written by Jake Adams. Jake Adams is an academic tutor and Simplifi EDU, an online tutoring business based in Santa Monica, CA that provides online resources for K-to-college, SAT & ACT prep, and college admissions applications. With over 14 years of professional teaching experience, Jake is dedicated to providing his clients with the best online teaching experience and access to undergraduate and graduate networks at colleges and universities across the country. Jack holds a BA in International Business and Marketing from Pepperdine University.

This article contains 12 links, which can be found at the bottom of the page.

How Do Marijuana Taxes Work?

Knowing how to calculate percentages will not only help you score well on math tests, but it will also help you in the real world. You can calculate tips at restaurants, find percentage changes in prices, and even determine stats for your favorite sports team. Although the language may seem confusing at first, calculating percentages can be quite simple.

We’ll go over the main interest problems you’ll see in math homework and business, and give you examples of daily interest calculations.

This article was written by Jake Adams. Jake Adams is an academic tutor and Simplifi EDU, an online tutoring business based in Santa Monica, CA that provides online resources for K-to-college, SAT & ACT prep, and college admissions applications. With over 14 years of professional teaching experience, Jake is dedicated to providing his clients with the best online teaching experience and access to undergraduate and graduate networks at colleges and universities across the country. Jack holds a BA in International Business and Marketing from Pepperdine University. This article has been viewed 8,238,291 times.

Missouri Car Sales Tax Calculator

To calculate a percentage, start by writing the number you want to convert to a percentage of the total value, so you end up with a fraction. Then, divide the top number by the bottom number and convert the amount to a decimal. Finally, multiply the number by 100 to find the ratio. Learn how to calculate discounts using percentages! Coupons or sales to customers, how much sales tax do you need to know? Use our simple sales tax calculator to find out how much sales tax your customers should pay. Enter the sales tax and amount, select whether to include sales tax, and the calculator will do the rest. If you don’t know the rate, download the free search tool on this page to find the correct state and local rates.

If you pay customers overseas, you can get a better deal on international transactions with your merchant account. We give you the course you see on Google, absolutely free of charge.

Link your account with PayPal to send and receive payments in multiple currencies, save on fees, and set up direct debit for your recurring payment needs.

Answered: A Laptop Has A Listed Price Of $635.95…

Sales tax may be imposed by your state, county or territory. To get the sales tax rate, you must add all the taxes in your location.

Taxes are never simple, but our handy sales tax tool will help you find the lowest local and state sales tax rates for your area.

You’ll need to enter your state, city, or county to find the right rate.

Solved 1. Find Out The Sub Total, Sales Tax And Total Charge

Once you know the local sales tax rate for your area, you can use the sales tax formula to determine how much your customers will pay for each sale.

Or make life easier with the handy calculator at the top of the page to get the sales tax details you need.

Select a state to view state and local sales tax rates and use the calculator to calculate your sales tax amount. Good job Jan 28 1) 2) Purpose: I use interest to determine sales tax, tips and commission.

Four Easy Ways To Calculate Percentages

Presentation on the topic: “Bell work January 28 1) 2) Image:

Figure out tax percentage from total, how to find tax percentage from total, calculate tax percentage from total, how to find sales tax percentage, how to calculate percentage amount from total, how to figure out sales tax percentage from total, how to calculate total percentage, how to figure sales tax percentage from total, how to calculate tax percentage from total, calculate total from percentage, how to calculate sales tax percentage from total, how to find percentage of total sales