General Ledger Reconciliation Template

General Ledger Reconciliation Template – Every submission and review is tracked and time stamped so you can easily provide your auditor with a detailed audit trail report.

Our account reconciliation software includes templates for special reconciliations such as prepaid expenses, fixed assets, and bank reconciliations. Use our GL to subledger template for standard reconciliations such as invoices, payables and more.

General Ledger Reconciliation Template

Post matching entries automatically, marking only those accounts that require review and reconciliation by your accounting team.

Ultimate Guide To Account Reconciliation

See which accounts have been reconciled and reviewed – and track account balances, reconciled amounts, and senders and ratings in one central template.

Our pre-configured solution includes templates, best practices, and smart account reconciliation tools to help reduce your balance reconciliation time.

With built-in templates, a familiar Excel interface, and our team of experts by your side, you’ll be up and running in weeks, not months.

Balance Sheet Reconciliation: Definition, Types & Examples

Veins are fully auditable. Use certification and validation dashboards and checklists to track status and details throughout your closing process.

Need to reconcile multiple currencies? Or to integrate sub-ledger data for age categorization and reserve analysis? We can build custom functions, custom reports and templates.

See how Vena works with Excel to support your planning in areas such as ad-hoc reporting and variance analysis.

What Is Account Reconciliation?

Connect directly to source systems – from GL, ERP systems, HRIS or FAST asset tracking systems (FAST) – so that appropriate GL accounts and sub-ledgers can be posted automatically.

With all your data under one roof, your financial reports, audits, regulations and management reports are all built on a single source of trusted and accurate numbers with guaranteed data integrity.

Import your Excel, CSV and flat files from your local system or cloud storage apps like Dropbox, OneDrive, SFTP and SharePoint.

Types General Ledger Reconciliation Ppt Powerpoint Presentation Pictures Structure Cpb

Bring data from your home systems, SQL databases, and data warehouses into Vena with our fast and secure web-based interface. Save time, protect financial assets and increase accuracy with a free bank reconciliation template. You can customize all of the templates provided below for business use or for personal account reconciliation. For more financial management tools, download Cash Flow and other accounting templates.

Calculate the balance of a company’s assets, liabilities and equity to get an idea of its financial position at any given time. The template includes rows for assets such as cash, receivables, inventory, and investments, along with liabilities, including accounts payable, loans, and payroll. Add your own line items to this Excel sheet, and the template will automatically calculate the total.

Use this template to track payment transactions, including supplier names, invoice numbers, amounts due and completed payments. This spreadsheet template makes it easy to organize important account information that can then be referenced when reconciling invoices. Customize the template by adding or removing columns to suit your business needs.

Using Balance Sheet Simulation Dashboards To Streamline The Modelling And Forecasting Process

Companies or individuals can use this ledger reconciliation (GL) template for bank reconciliations. Businesses can also use it to balance accounts, such as accounts payable, by modifying the template to display the appropriate account information. Enter the balance from your bank or subledger statement along with the general ledger balance, and adjust the amount based on outstanding deposits and checks. The template then reflects any variances between records. If they don’t fail, you can review the records for errors or other discrepancies that need to be resolved.

This simple bank reconciliation template is designed for personal or business use, and you can download it as an Excel file or as a Google Sheets template. Enter your financial details, and the template automatically calculates the total so you can quickly see if your bank statements and accounting journals are reconciled. To create a continuous record, copy and paste a blank template into a new tab for each month of the year.

Many businesses use a small cash fund to pay small expenses. You can use this template to reconcile petty cash accounts to ensure that you have accounted for actual receipts and that the balance amounts are correct. How often you need to reconcile accounts depends on how often they are used.

Best Selling Checkbook App Spreadsheet

Reconcile business credit card accounts with transaction receipts, and generate expense reports for documentation. Modify the template to include business expenses you need to track. Then enter each invoice amount along with the date and account number. This template can be used for travel, entertaining clients, or other formal business expenses. Make sure your credit card statement matches the transactions reported on the reconciliation template.

This comprehensive cash flow template allows you to see a breakdown of each day’s total payments, payments and expenses. Enter the first day of the month, and the template will fill in the following dates, providing a detailed view of the daily cash flow. The template also shows the ending cash position so you can quickly see if it fits your balance sheet.

Is the process of comparing a company ledger, or master accounting record, with subsidiary ledgers or bank statements to identify and resolve discrepancies. Because you can do this process with internal subledgers for specific balance sheet accounts or external bank statements, this process is also known as

Deposit And Gl Reconciliation Report For Banks

. It is an important part of monthly accounting to ensure accurate records, prepare for internal audits, quickly detect fraud and manage cash flow. Individuals can also reconcile monthly bank statements with personal records to ensure they know their correct bank account balance and avoid overdrafts.

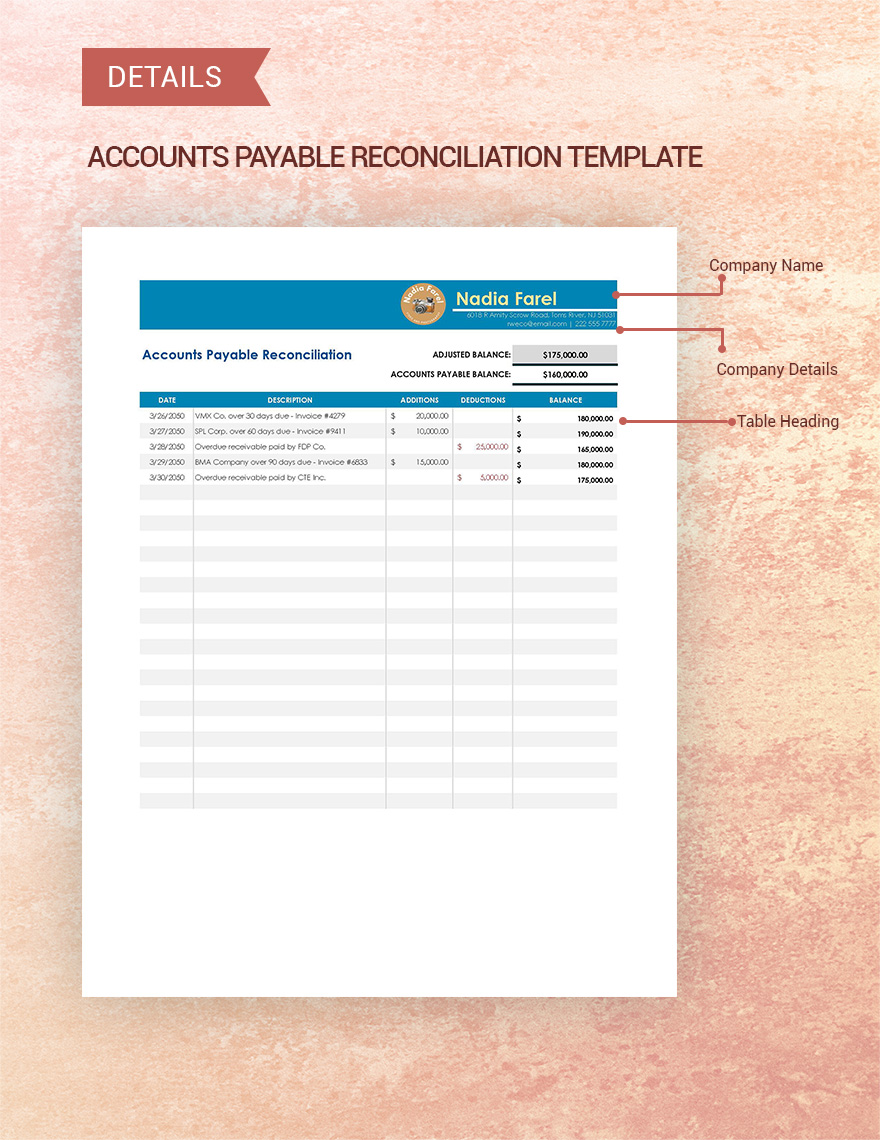

Reconciliation of accounts payable (AP) accounts involves matching general ledger balances with AP subsidiary ledgers (or other records showing AP transactions). If the two ledgers match, the accounts are reconciled. Otherwise, the two ledgers must be closely compared to identify errors such as missing or incorrect entries.

This process is usually done monthly for efficiency and to avoid mistakes from one month or year to the next. Reconciliation of invoices can be done manually or with software, depending on the size of your business and your accounting needs.

Bank Reconciliation Excel Example

Documentation is important to all aspects of accounting, and organizations usually have reconciliation policies that must be followed, including deadlines for submitting completed reconciliations. Here are the basic steps involved and items to track when accounts fail:

Regular reconciliation of accounts can help maintain efficient processes, reduce errors in the long run and limit the stress of financial differences.

Empower your people to go above and beyond with a flexible platform designed to fit the needs of your team – and adapt as those needs change.

Visioncore How To Topics

The platform makes it easy to plan, capture, manage and report on work from anywhere, helping your team to be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity about the work being done, there’s no telling how much more they can accomplish in the same amount of time. Try it for free, today. Reconciliation reports are considered a data control tool and are used by accountants to ensure that loan-related transactions are linked to the general ledger. Some of the main features in this type of report are that for each specific GL account selected by the user, listed and matched with related loan transactions. The column lists the months up to the current period to make it easier to track historical balances. You will find examples of this type of report below.

Banks use GL and Loan Reconciliation Reports to automate and expedite the monthly closing process and ensure that loan transaction data matches the related GL postings. When used as part of good business practices in the accounting department, banks can increase the efficiency of their accounting staff, and this can reduce the possibility of errors in financial reports.

Jd Edwards Enterpriseone General Accounting Reports

Below is an example of a loan and GL reconciliation report with user defined parameters for entities and accounts.

The progressive accounting department sometimes uses various loan reconciliation reports and GLs, along with detailed loan reports, income statements, balance sheets, cash flow statements, and other management and control tools.

Actual data (historical transactions) usually comes from loan management systems and Enterprise Resource Planning (ERP) systems such as: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Acumatica, Netsuite and others.

Credit Card Reconciliation Template

In analyzes with budgets or forecasts, the planning data usually comes from built-in Excel spreadsheet models or from professional Enterprise Performance Management (CPM / EPM) solutions.

Https:///wp-content/uploads/2021/09/Industry_Bank10-scaled-1.jpg 1438 2560 Nils R. https:///wp-content/uploads/2019/10/solver-logo-final.png Nils R. 2021-09-09 12:49:15 2021-09-09 12:49:15 Loan and GL reconciliation reports for banks Having a standardized balance sheet reconciliation is a known best practice. Increase the efficiency of your month-end closing process by incorporating a consistent and reliable framework. This balance reconciliation is feature complete – dynamic formulas, conditional formats, and based on a simple methodology. This balance reconciliation is free to download and contains no macros – it’s simple

941 reconciliation to general ledger template, general ledger account reconciliation software, general ledger reconciliation software, general ledger reconciliation example, general ledger account reconciliation, general ledger account reconciliation template, general ledger reconciliation best practices, general ledger reconciliation template excel, general ledger reconciliation process, 941 reconciliation to general ledger, general ledger account reconciliation template excel, general ledger reconciliation