How To Create A Projected Balance Sheet

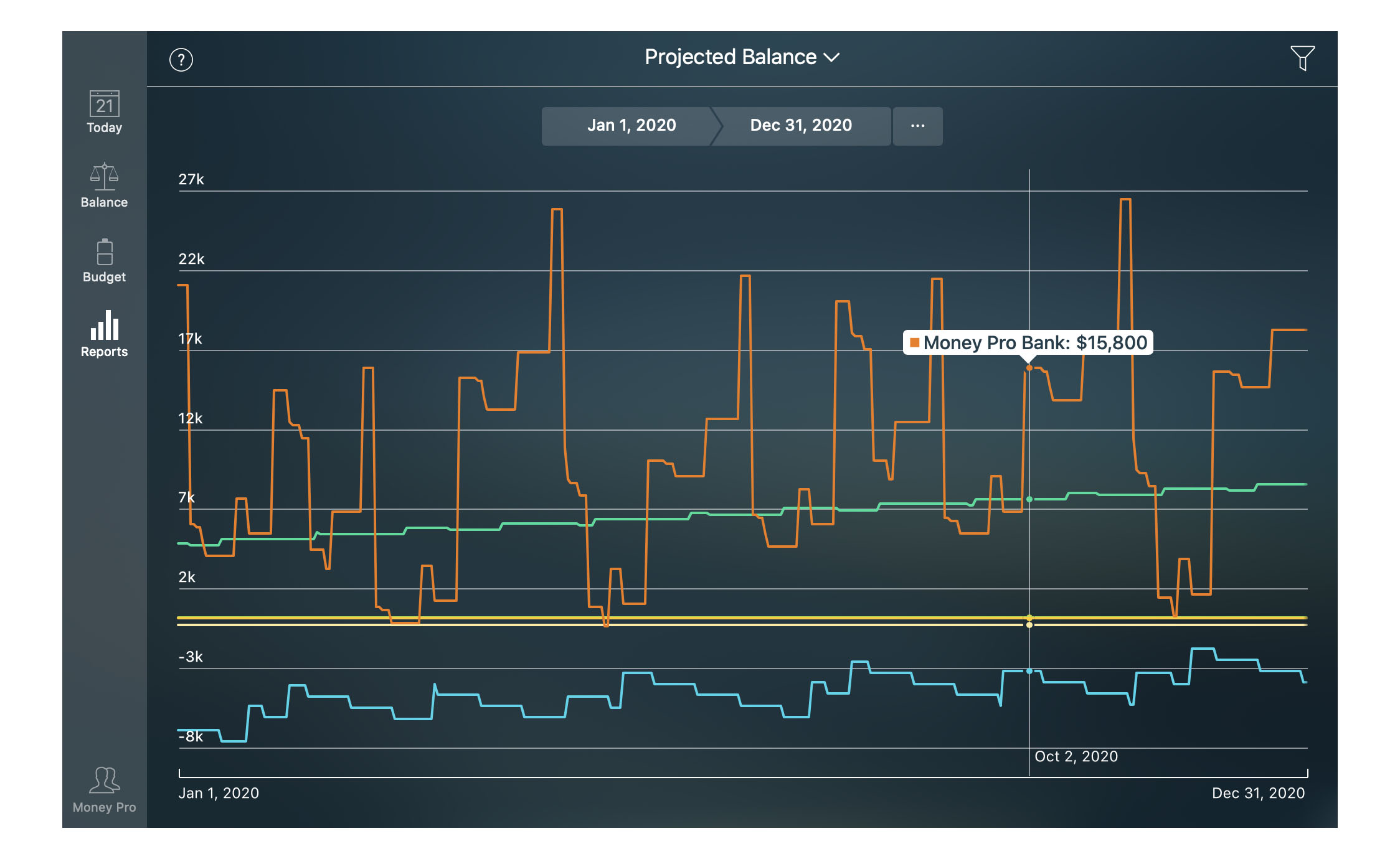

How To Create A Projected Balance Sheet – Budget forecasts are considered key planning tools and are used by CFOs and project managers to estimate components of liabilities and assets, as well as to drive cash flow forecasting. A key task in such a forecasting model is to extract net income and depreciation data from the profit and loss forecast and feed it into the cash flow forecast. Shows monthly historical data up to the current time and forecast data for the remaining months of the year. Part of the logic provides a timely estimate for credits and debits. Monthly statements provide managers with insights such as major uptrends and downtrends. Below you will find an example of this type of forecasting model.

Businesses and organizations use budget forecasting models to drive cash flow forecasting and to help managers make timely decisions based on the resulting information. When used as part of good business practices in the financial planning and analysis (FP&A) and accounting department, the company can improve its asset, liability and cash flow decisions and reduce the risk of not being able to meet the own financial obligations.

How To Create A Projected Balance Sheet

This is an example of a monthly budget forecast report with actual data from the beginning of the year and a forecast for the rest of the year.

How To Make Projected Balance Sheets

Business planning and analysis (FP&A) and accounting departments sometimes use many different budget forecasting models, including profit and loss and cash flow forecasting and management and other management tools.

The data (historical transactions) are generally obtained from Enterprise Resource Planning (ERP) systems such as: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL, Sage Intacct, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP ByDesign, Netsuite and others.

In analyzes where budgeting or forecasting is used, planning data often comes from internal Excel spreadsheet templates or professional enterprise performance management (CPM/EPM) solutions. . Both of these skills are important when mastering the art of financial modeling. This guide looks, step-by-step, at how to calculate and then forecast each of the key line items to predict the perfect balance sheet and build a 3-statement financial model.

Using Financial Statements To Evaluate Financial Choices

Accounts Receivable, Inventory, and Accounts Payable are unique in that they have a specific forecasting method. Since all of these accounts are involved in the cash and operating cycle, it is helpful to have “pending dates” for all of these accounts. Using the formula for the respective due dates, we can predict future cash flows, inventory, and accounts payable.

After we find historical values for the relevant dates, we can use these trends and reverse engineer the date formula to find cash, inventory, or accounts payable for a specific period.

Let’s take the example of utility bills. In the previous year, payable days were 120. If sales revenue is $100,000 for the year, Accounts Payable is found from:

Financial Data Visualization

We may forecast other current resources as a single line item or split them as individual line items. Applying balanced linear objects via the latter method is a bit more complicated, but will allow for more granularity and dynamism in the model.

A quick and dirty way to process budget questions for current assets is to use every dollar forecast for these accounts in the future or follow the existing trend.

The depreciation of PP&E is different from the depreciation of other current assets and long-term assets. This forecast requires the writing of an amortization schedule for each class of PP&E. The balance shown in the balance sheet is the closing balance.

Business Plan Template

As can be seen, the use of the amortization plan is linked to both the balance sheet and the income statement. We use the closing balance in the balance sheet and the depreciation expense in the income statement.

Similar to PP&E with its amortization schedule, long-term debt is forecasted using a debt schedule. This program outlines each class of loans and produces the interest expense for each period. The balance reported in the balance sheet is also the final balance of the long-term debt or the sum of all the final balances of each debt.

It is important to note that, here, the interest expense is added back to the initial balance. Conversely, the depreciation expense is deducted from the initial PP&E balance. Keep this in mind and don’t forget to use the appropriate symbols.

Grocery Store Financial Model Excel Template

Fairness can be one of the easier tasks when projecting off-balance sheet items. More often than not, the equity remains constant across all periods, so forecasts will generally roll to coincide with the latest known period.

Forecasting retained earnings actually involves projecting net income and dividends rather than the retained earnings themselves. This means that in order to complete the project balance sheet items, the project income statement items must be completed so that the net income is immediately available. As always, the balance shown in the balance sheet is the closing balance.

Since we need income statement entries, this is the best way to report balance sheet entries:

How To Make Projected P& L/budgets

Thank you for reading the CFI’s guide to insurance balance sheet items. To continue learning and advance your career, additional CFI resources will be very helpful:

Financial Modeling & Insurance Analyst (FMVA)® Learn more Commercial Banking & Credit Analyst (CBCA)™ Learn more Capital Markets & Securities Analyst (CMSA)® Learn more Certified Business Intelligence & Data Analyst (BIDA )™ Learn more Financial Planning & Wealth Management (FPWM)® Learn more

Free Business Design Guides CFI’s Free Business Design Guides are comprehensive and comprehensive resources covering template design, template building blocks, and tips, tricks, and…

Financial Forecast Defined

SQL Data Types What are SQL data types? Structured Query Language (SQL) has many different data types that allow it to store various types of information…

Structured Query Language (SQL) What is Structured Query Language (SQL)? Structured Query Language (SQL) is a specialized programming language designed to interact with databases…. Interim balance sheet: – The interim balance sheet is an unaudited balance sheet. It is prepared on the basis of past data, i.e. for the period that has ended.

Eg. : Suppose our balance sheet as of March 31, 2020, which has not been completed, but our banks or other companies request the balance sheet, so we provide them with the supply balance sheet.

Top 10 Balance Sheet Templates For Company’s Financial Analysis

Accounting Balance:- Accounting balance is prepared for future data (of started but not finished period) on a forward looking basis i.e. for already started but not finished period.

Eg. : Suppose, for your CC limit extension or to get new loans, your bank asks for your balance sheet for the current year, i.e. not yet completed. In that case, on an estimate (based on past performance) we provide our bank with an estimated balance sheet.

Budget:- Budget is prepared for future data on a forecast basis i.e. for which the period has not started.

Balance Sheet Forecast

From 01/04/2020 to 30/06/2020, from 01/04/2020 to 31/03/2021 and from 01/04/2021 to 31/03/2022, so the balance sheets are as follows:-

The preparation of the financial statements for the period from April 1, 2020 to March 31, 2021 is the accounting balance sheet.

Tax Shastra is a sub-scientific foundation. – a knowledge base for individuals, companies and professionals, managed and directed exclusively by Ratan Sarraf, where you can know your taxes and easy money. Template Increase value in board meetings with our number 1 most requested property: our clear and concise deck. Request now

Steps To Seed Funding

Budget forecasting is most effective when projecting the financial impact of line items at a granular level. But with so many other financial and accounting tasks to deal with, it’s easy for in-depth budget forecasting to fall off your priority list. Once you’re able to build financial resilience around your budget forecasts, it will be easier to understand the financial impact of your plans. That’s how.

The budget is responsible for answering an important question in your business: What is the financial impact of our operations?

But many companies are waiting too long to establish a high level of financial strength around their balance sheet. The sooner you get used to granular budget forecasting, the sooner you’ll be able to understand the real financial impact of what you’re building into your financial model.

How To Prepare A Profit & Loss Statement: It’s Easy With Our Free Template

However, spreadsheet-based financial models do not allow P&L assumptions to be easily linked to the financial impact on the balance sheet. Switching to financial modeling software can help you increase the accuracy of your budget forecasts and give you insights into the financial impact of all your operating decisions.

Your budget forecast is a pinpoint view of your company’s assets, liabilities, and equity. It is one component of the three-piece financial model that generates substantial changes in your company’s balance sheet, the other components are P&L forecasts and cash flow forecasts.

It is important to keep the budget projection in mind as you build the financial model. Every assumption you make in your model affects the balance sheet, and all of these effects boil down

A Curated Set Of Free Planning Tools For Cannabis/hemp Business Startups

How to do a projected balance sheet, how to create a projected balance sheet, projected balance sheet template excel, projected balance sheet calculator, how to make projected balance sheet in excel, projected balance sheet example, projected balance sheet template, projected balance sheet, how to make projected balance sheet, projected balance sheet format, how to create balance sheet, how to make a projected balance sheet