How To Calculate Annual Percentage Rate On A Loan

How To Calculate Annual Percentage Rate On A Loan – Joseph Rich holds a bachelor’s degree in economics and a master’s degree in finance, specializing in economics and investment analysis.

The annual percentage rate (APR) is the simple interest rate combined with other fees the bank may charge, such as finance charges and prepaid fees. It represents the actual cost of borrowing money if a loan is an interest-free loan.

How To Calculate Annual Percentage Rate On A Loan

If you take out a loan with a relatively high interest rate but low fees, you may have a lower interest rate than a loan with a low interest rate but high fees. This is why it is recommended to compare the effective interest rate of two financial institutions, rather than just comparing interest rates.

Solved: ‘calculate The Finance Charge (in ) And The Annual Percentage Rate For The Installment Loan By Using The Apr Formula Round Dollar Amounts To The Nearest Cent And Percentages To One

Note that the calculator uses the Newton-Raphson method to calculate the APR and takes into account regular interest payments, so the APR results will differ between the APR formula and the APR calculator.

For example, let’s say you take out a $5,000 loan at 6% interest for 2 years. The bank has already informed you that the finance charges will be $200. What will the loan APR be?

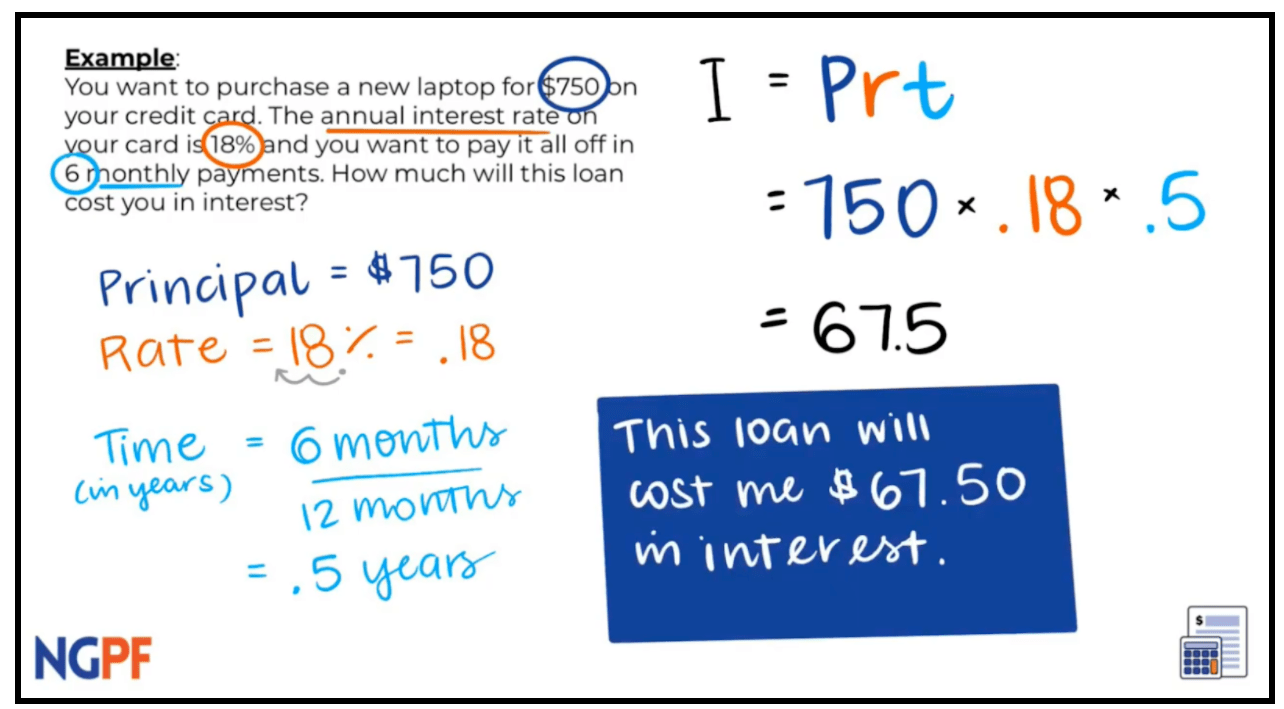

Before using the APR formula above, we should find the total interest paid. We will need to use the simple interest formula below to calculate the total interest.

How To Calculate Annual Percentage Rate: 12 Steps (with Pictures)

When shopping for different loans, it’s a good idea to compare the effective interest rate between them instead of just the interest rate, as the annual interest rate represents the actual cost of borrowing a loan.

You are looking for a car loan of $10,000 for 4 years. Bank A has quoted you a 5% loan with $100 financing fees, while Bank B is willing to offer you a 4% loan but with $600 financing fees. How can you know which loan would be a better option? We need to compare the APR of both and see which one offers the lower APR.

But again, we first need to calculate the total simple interest so we can plug it into the APR formula.

How To Calculate Daily Compound Interest In Excel

Since Bank A has a lower APR, this is the more desirable loan. This applies even if bank A has a higher interest rate.

Another way to find out which is better is to compare interest rates and finance charges. Bank A charged you $2,000 in interest and $100 in financing fees, for a total of $2,100. The bank, on the other hand, will pay $1,600 and $600 in financing fees, for a total of $2,200.

Banks are required to disclose the effective interest rate for each loan so that you are not surprised by hidden fees.

:max_bytes(150000):strip_icc()/calculate-monthly-interest-92709ed0edc6470380a4444e2aecc37a-c5aa9207689c418da774c116afe62227.png?strip=all)

Present Value Of An Annuity: How To Calculate & Examples

The effective interest rate on loans (except credit cards discussed in the next section) is what we calculated above. APR includes full interest and all finance charges.

All else being equal, the riskier the loan, the higher the interest rate and APR. For example, car loans will have a higher interest rate than mortgages because the borrower is more likely to miss payments on their car than on their home. Both cases are bad, but it is better if the bank takes the car than the house.

Financing fees associated with auto loans include origination fees, processing fees, points paid for the loan and dealer fees. You can use our car loan calculator to calculate the payment or maximum price you can afford.

Interest Rate Vs Apr: What’s The Difference? A Guide To Interest Rates

Home loans have similar financing fees, but have some extra features. For mortgages, certain financing fees include origination fees, processing fees, points paid for the loan, mortgage insurance, closing costs and mortgage broker fees.

:max_bytes(150000):strip_icc()/Interest-formula_7-589b92f45f9b58819cafefaf.jpg?strip=all)

In the case of credit cards, the effective interest rate and the interest rate are essentially the same thing, as is the case with credit cards. Although there are other credit card borrowing costs, they are not included in the credit card APR.

The interest rate on a credit card will usually be the highest of any type of loan because credit cards are the riskiest type of loan. If you stop making payments on your credit card, the bank has no collateral.

How To Calculate The Apr Of A Loan

But if you default on your mortgage or car loan, the lender can legally repossess the house or car, sell it and recoup as much of the loan as possible. The credit card issuer knows this and must compensate for the additional credit card risks.

In the case of credit cards, it is also possible to never pay interest. If you pay your balance in full each month, you pay no interest. Because credit cards have high APRs, it’s a good idea to pay off the balance each month.

But if you can’t pay off the balance in full, be sure to watch out for introductory APR rates. Some lenders will introduce a low APR for a certain period, and then raise the APR over time.

How To Use Pmt Function In Google Sheets [2020]

. This is the rate that will be charged on purchases that have not been paid in full by the end of the month.

. This is the new rate that would apply if you misused the card, for example if you didn’t pay on time. This will be the highest APR.

There is also a difference between fixed and variable APR. Fixed APRs don’t change if you miss a payment and incur a penalty. Then the lender can raise the interest rate. Variable APR varies just like the prime rate does.

What Is Annual Percentage Yield (apy)?

Prime rate is the interest that banks charge each other for short-term loans. If the prime rate increases, the credit card interest rate may also increase.

The main difference between the effective interest rate and the nominal interest rate is that the nominal interest rate does not take into effect any financing or prepaid fees; it’s just simple interest.

In our first example, we had a $5,000 loan for 2 years at 6%. We have calculated that the UTB is 8%. The nominal interest rate we saw before adding financing costs was just 6%.

How Is Credit Card Interest Actually Calculated?

APY stands for Annual Percentage Yield. APY is the interest rate calculated when compounding takes effect. Since interest is compounded, the higher the frequency, the higher the total interest.

Although interest can technically increase at any time, the most common frequencies are daily, monthly, quarterly, semi-annually and annually. These are also available options in our APY calculator.

So they are the same, both have annual interest rates (and why they both have “annual” in their name).

What Is An Apr? Lemonade Homeowners Insurance

You can also use our interest calculator to compare the total interest between simple interest and compound interest. APR is the annual percentage rate. Basically, APR means the total cost of borrowing money.

Before you take out a loan or credit for your business, or choose a new business credit card, you should have a good understanding of how the effective interest rate works. This way you can compare prices and find the best one for your business.

While APR represents the annual percentage rate and interest rate at which you borrow money, APR is different from interest rate, which is the percentage the lender charges on your business loan or credit card.

What Is Apr? Mortgage Apr?

The rest of the effective interest rate consists of fees that the lender charges when you take out your loan or use your credit card. These fees are split along with the interest amount and you pay both at the same time, in instalments.

If you only focus on the APR or interest rate when choosing a loan or credit card, you could miss out on saving money, or even end up paying more than you expected.

In addition, you may have different interest rates depending on the type of loan you take out. Most often this happens with a business credit card. The effective interest rate you pay on a cash advance or balance transfer may be higher or lower than your regular interest rate for purchases. These may or may not be relevant to your business: Cash advance APR shouldn’t play a big role in your decision unless you plan to use the cash advance a lot.

How To Calculate Growth Percentage And Average Annual Growth Rate

In some cases, a credit card with a 0% grace period may be more attractive than one with a fixed APR. You can use introductory pricing to make new purchases for your business. If you pay off your debt before the introductory period ends, you basically borrow money for free.

If you don’t make payments or spend more than your credit limit, the credit card company will charge you a penalty on the excess balance.

To see how APR can affect business decisions, consider this example. Say you have two loans to choose from:

Solved] Find The Annual Percentage Yield (apy) In The Following…

Let’s say you chose the loan with the lowest interest rate: Loan B, at 6%. It may seem like a smart move, but with the fees added to the interest rate, you have one.

Calculate annual interest rate on loan, how to calculate annual percentage rate, how to calculate annual percentage rate on a car loan, how to calculate the annual percentage rate, how to calculate annual percentage rate on a loan, annual percentage rate for car loan, how do you calculate annual percentage rate, how to calculate annual interest rate on a loan, how to calculate loan percentage, what is annual percentage rate on a loan, calculate annual percentage rate, annual percentage rate car loan